The economy remains on a solid trajectory this year despite a slower pace of growth. Below, we provide an update on some recent data that gives insight into crucial parts of the economy.

EMPLOYMENT

The latest employment report (as reported by the US Bureau of Labor Statistics) is encouraging, with 272,000 jobs added in May, surpassing the highest estimates for the period. Although the unemployment rate did rise by .1% to 4%, we see potential for improvement in the job market. One trend we are monitoring is weekly jobless claims, which have seen 3 weeks of rising claims. While this is still low by historical standards, it is a trend we are watching. Stay tuned for further updates.

INFLATION

May brought positive news in the fight against inflation. The latest CPI report showed no growth in inflation, with many categories showing price decreases. PPI, an index that tracks producer prices, showed a drop of -.2% with most categories falling in price. Both ISM reports for May also indicated a decrease in the prices paid for components. While the Fed remains cautious about the inflation outlook, they are inching closer to a more optimistic stance.

BUSINESS ACTIVITY

Businesses activity remains mixed with service-related businesses outpacing goods producers. The May ISM Services index came in at 53.8, indicating expansion in the service sector, while ISM Manufacturing showed a contraction at 48.7, suggesting a slowdown in manufacturing. Trade flows picked up this month after slumping in April, which could be a positive sign for businesses involved in international trade. Surveys show that inflation and higher interest rates as the biggest concerns for business owners. If the recent trends continue, we should see improvement on both of these metrics. This could lead to a more robust business environment during the second half of the year.

CONCLUSION

The economy may have slowed from last year’s pace, but there is little cause for concern at the macro level. Consumers, who report affordability as their biggest economic concern, can take heart in recent reports showing improvement, with many prices falling from their previous highs. We anticipate the Fed to initiate interest rate reductions soon, a move that will bolster equity and bond valuations.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Atlanta Fed GDPNow model is a real-time econometric model which forecasts GDP growth in the current quarter.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

ISM Services and ISM Manufacturing are statistics published by the Institute of Supply Management.

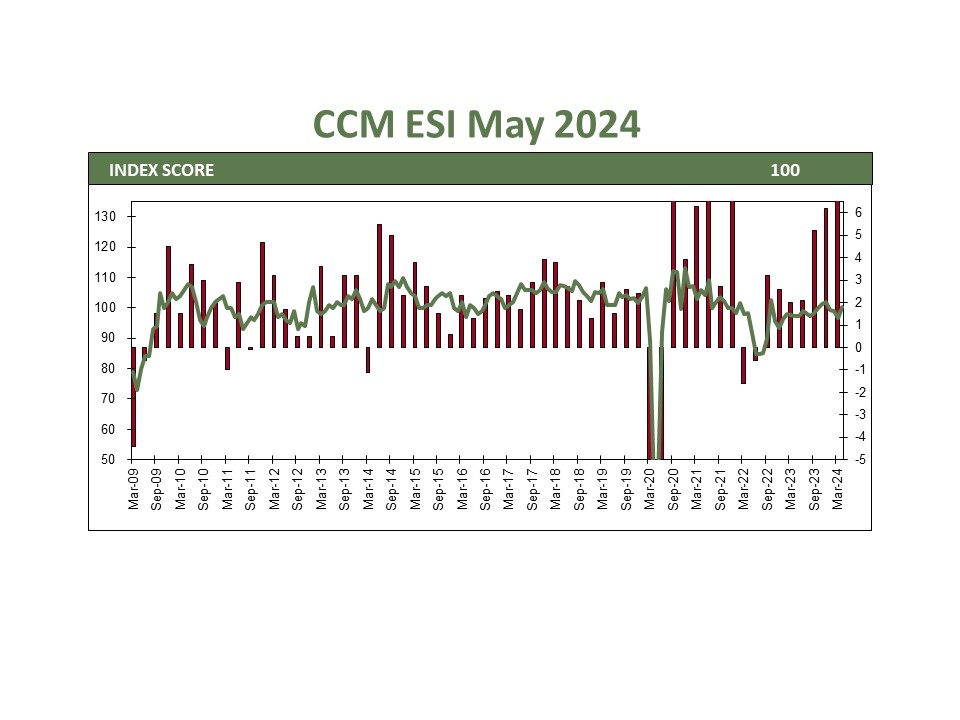

Citigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. With a sum over 0, its economic performance generally beats market expectations. With a sum below 0, its economic conditions are generally worse than expected.