The latest economic data offers a nuanced view of the U.S. economy as 2024 draws to a close.

Inflationary trends showed a slight uptick, with the Consumer Price Index (CPI) rising 0.3% in November. This pushed the year-over-year inflation rate to 2.7%. Core inflation, which strips out volatile food and energy components, also increased by 0.3% for the month and 3.3% on an annual basis. Producer-side inflation metrics suggest persistent cost pressures in the supply chain. The Producer Price Index (PPI) for final demand rose 0.4% in November, marking a 3.0% increase over the last 12 months. While inflation has eased from its peak levels, it continues to hover above the Federal Reserve’s target of 2%.

Wage dynamics provided a mixed picture. Real average hourly earnings were flat in November, as the 0.4% gain in nominal hourly earnings was offset by a comparable rise in consumer prices. On a more positive note, real average weekly earnings rose by 0.3%, offering modest relief for workers.

Labor market indicators remain robust. Nonfarm payrolls grew by 227,000 jobs in November, signaling ongoing strength in employment. The unemployment rate held steady at 4.2%, reflecting tight conditions. Job growth was particularly notable in health care, leisure, and hospitality sectors. However, the retail trade sector experienced job losses, tempering the overall gains. This is likely due to seasonal adjustments to holiday seasonal hiring.

Productivity trends were mixed. Nonfarm business sector productivity advanced by 2.2% in the third quarter, accompanied by a 0.8% rise in unit labor costs. In manufacturing, productivity improved by 0.9%, but unit labor costs increased by 1.7%, indicating rising wage pressures.

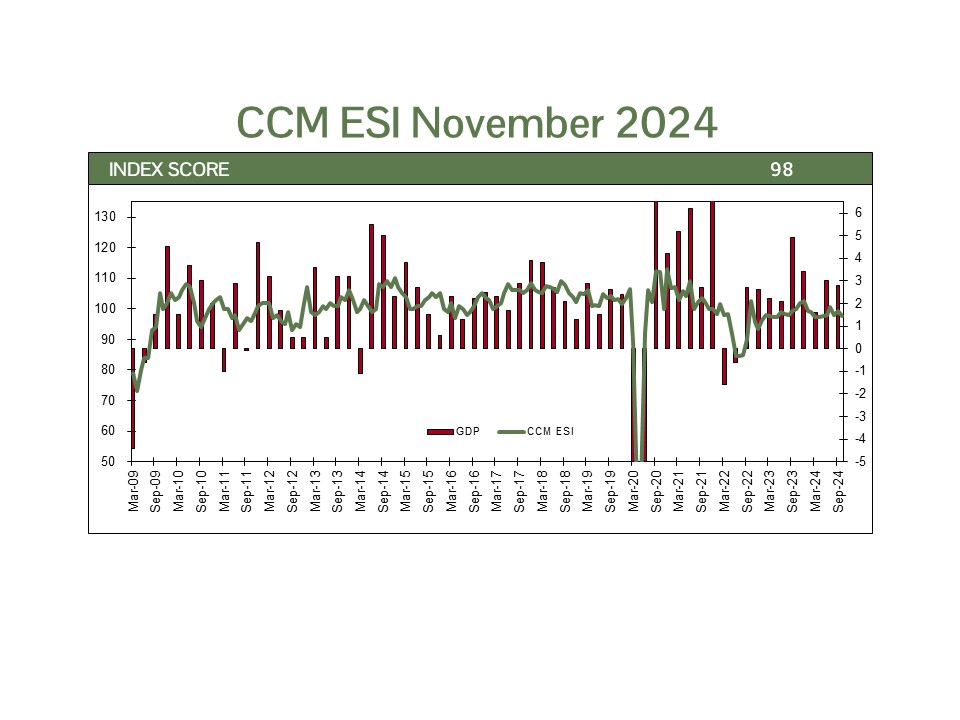

Overall, these economic indicators highlight a U.S. economy that continues to expand, though challenges remain in addressing inflationary pressures and ensuring sustained real wage growth. The Atlanta Fed’s GDP Now model estimates growth in the final quarter to be 3.3% which would bring a stellar close to the year. Looking ahead, investments in AI will drive growth in 2025 as more companies incorporate the latest models into their operations.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

Technical Terms:

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The Producer Price Index (PPI) is a family of indexes produced by the Bureau of Labor Statistics that measures the average change over time in selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. This contrasts with other measures, such as the Consumer Price Index (CPI), that measure price change from the purchaser’s perspective. Sellers’ and purchasers’ prices may differ due to government subsidies, sales and excise taxes, and distribution costs.

GDPNow is a nowcasting model for gross domestic product (GDP) growth that synthesizes the bridge equation approach relating GDP subcomponents to monthly source data with factor model and Bayesian vector autoregression approaches. The GDPNow model forecasts GDP growth by aggregating 13 subcomponents that make up GDP with the chain-weighting methodology used by the US Bureau of Economic Analysis.