Business Activity Slowing

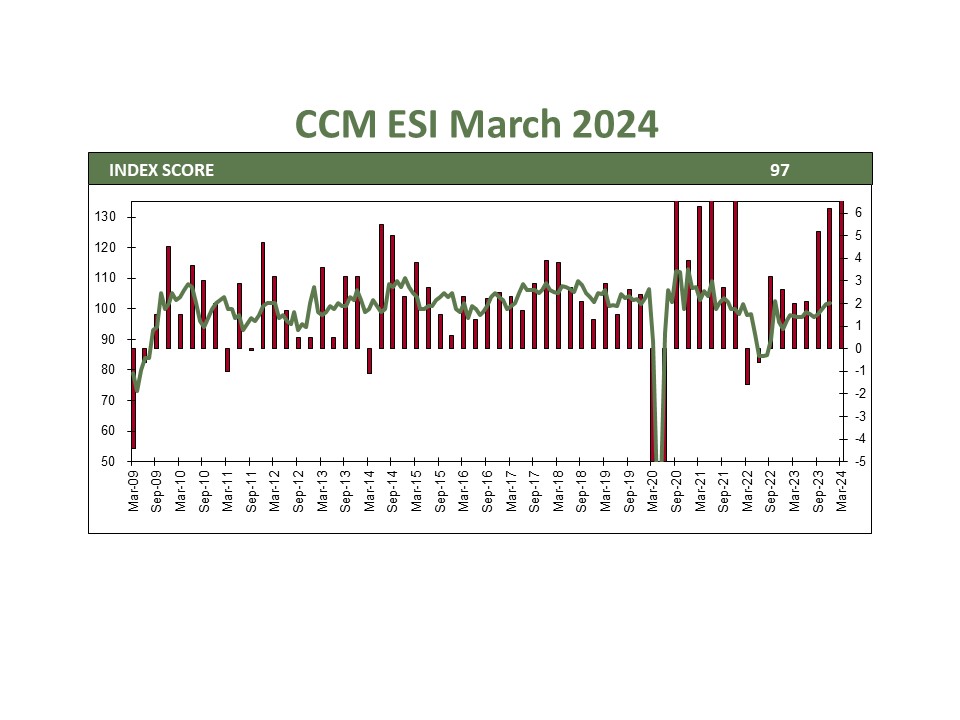

The US economic outlook has become murky, with several recent releases casting doubt on the strength we saw coming into the year. The Citigroup Economic Surprise index, which tracks economic releases versus expectations, has fallen since mid-April. While we have witnessed oscillations in the post-COVID recovery, the recent data has been broad-based, with manufacturing, services, and housing all showing weaker activity. Even more concerning is this is happening while prices continue to rise. It is too early to tell whether this is a temporary slowdown or something more pronounced. We are not changing our positive view of the economy, but the latest data has caught our attention.

Consumers Keep Faith

Despite the slowdown in activity, the labor market remains robust, a testament to the economy’s resilience. Weekly jobless claims have averaged 210,000 this year, and the latest employment report showed 175,000 jobs added in April. Consumer spending remains high, which indicates that employees are optimistic about their future employment. Job openings have been declining since late 2022, yet they remain 1.3M above the pre-pandemic level. Given the tight labor market, we predict employers will look through any period of weakness and hold onto hires. This should make any downturn relatively shallow.

Fed Revisited

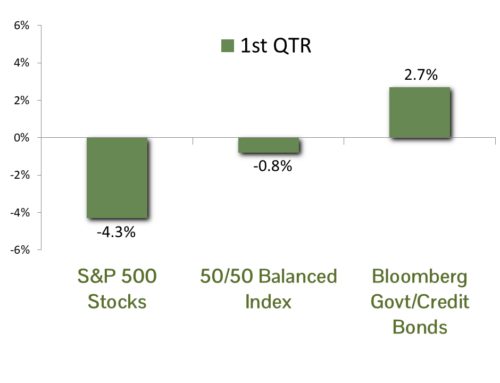

Expectations for Fed Funds rate reductions have been lowered this year as inflation has been more persistent than anticipated. As many as 6 cuts were predicted in January of this year, while the latest data shows less than 2. Being an election year complicates matters as the Fed doesn’t want to be seen as putting its finger on the scale. The fact remains that the Fed is tighter than it has been since the early 2000’s and cuts are more likely than not to happen this year. The market seems to agree as the S&P rallied and bond yields dropped after Friday’s weaker than expected employment report, indicating the market’s anticipation of the Fed’s actions.

In Conclusion

We see the recent economic weakness as a temporary blip in a strong economic uptrend. While troubled by high prices, consumers continue to spend as their job prospects seem secure. Any pronounced weakness will be met by an aggressive Fed response that will make any downturn mild.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Atlanta Fed GDPNow model is a real-time econometric model which forecasts GDP growth in the current quarter.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

Citigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. With a sum over 0, its economic performance generally beats market expectations. With a sum below 0, its economic conditions are generally worse than expected.