SUMMARY:

- Income return consists of stock dividends and interest payments.

- Total return consists of both income return and price return (appreciation).

- Income return is a very important component of a portfolio’s return, but it is short-sighted to focus only on income when investing.

- A focus on income return can create a dysfunctional bias for slow-growing dividend stocks or high-yielding junk bonds.

- For taxable portfolios, the capital gains tax on appreciation is generally lower than the ordinary income tax assessed on income return. On an after-tax basis, price return is therefore preferable to income return.

- We always highly advise our clients to maintain a total return mindset when determining their investment policy.

Perhaps the most common mistake that investors make is the preference for income return versus total return in their investment portfolio. To define, income return consists of stock dividends and bond interest payments. Total return, on the other hand, consists of both income return and price return (appreciation). Simply put, it is the total return an investor earns on his portfolio, not just the portion generated by dividends and interest.

It is understandable why investors often focus on income return, since a solid income stream and “cash in hand” is more tangible than the “paper profits” that accrue as Apple stock makes its way from $240 to $260 per share. To be clear, we are not slighting the importance of income return for investors – in the case of stocks, dividend returns have accounted for over 40% of total stock market returns since 1930. However, the majority of total return is due to appreciating stock prices, and total return is the true and all-encompassing measure of investing success.

For bondholders, price return (aka appreciation) plays a much smaller role in their total return, as bonds are much closer to a pure income investment dictated by a form of contract. As such, they are a safer investing option and generally offer a lower total return than that for stocks. Still, appreciation plays an important role in the total return for bonds. In 2019, for example, bonds have returned roughly 8.5% even though their income return is only around 3%.

For investors who maintain a bias for income return, the implication for their portfolios’ total return is typically dysfunctional (and often highly so). For example, many income-biased investors load their stock portfolios with high dividend paying securities. However, these issues almost always offer limited growth potential. On the bond side of the portfolio, a focus on income return can be downright lethal. This “quest for yield” at the expense of consideration for total return often leads an investor into high-yielding “junk” bonds, where the lure of an 8% yield can end in the loss of 100% when the company ultimately goes bankrupt and the bonds become worthless.

Our preference for a total return investing viewpoint versus a short-sighted focus on income is strongly endorsed when evaluating investments on an after-tax basis – income return is taxed as ordinary income, and the taxes are paid at the investor’s marginal tax rate. For higher-income investors, this rate ranges from 32 to 37 percent. When a security is sold for a gain, however, the appreciation is taxed as a capital gain. For the majority of investors the long-term capital gains tax rate is only 15 percent. Therefore, from an after-tax basis there no question regarding the advantage of price versus income returns.

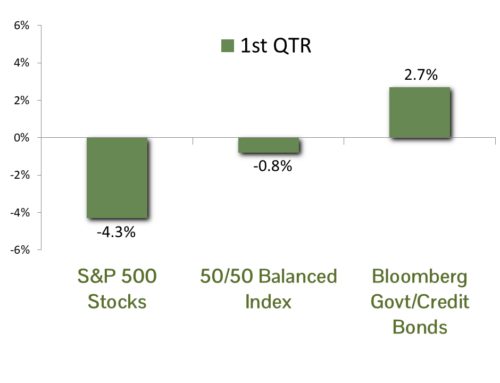

A final note on the importance of total return is for investors who rely on their investment portfolio for routine cash withdrawals. The “Four Percent Rule” is a widely accepted rule of thumb in investing where investors are assumed to safely be able to withdraw 4% of their portfolio’s value each year to supplement their retirement income (e.g., a couple with a $1,000,000 portfolio would withdraw $25,000 each year). The assumption is that a typical balanced portfolio return of 8% would cover the 4% withdrawal, annual inflation of 2-3% and a 1-2% “pad” for safety’s sake. However, in today’s world of 2% yields, it is obvious that 8% returns are simply not possible in today’s investing climate without price appreciation. We always highly advise our clients to maintain a total return mindset when determining their investment policy.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ Composite Index is a readily available, capitalization-weighted index of over 2,500 domestic and international companies listed on the NASDAQ Stock Market.

The Barclay’s Government/Credit Index is the non-securitized component of the U.S. Aggregate Index. The index includes US Treasuries, government-related issues and corporate bonds

The ICE BofAML 0-3 Month US Treasury Bill Index is a subset of ICE BofAML US Treasury Bill Index including all securities with a remaining term to final maturity less than 3 months.

All blended benchmarks are static blends.

Technical Terms (definitions sourced from Investopedia)

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The Producer Price Index (PPI) measures the average change over time in the prices domestic producers receive for their output. It is a measure of inflation at the wholesale level that is compiled from thousands of indexes measuring producer prices by industry and product category. The index is published monthly by the U.S. Bureau of Labor Statistics (BLS)