In their October 19, 2024 edition The Economist published a particularly interesting special report on the state of the American economy. As a follow-up to our recent post on American exceptionalism (see Clearing Up Some Common Misconceptions) we offer some select points from the report that belie the gloomy mood of Americans regarding the domestic economy:

On the U.S. versus its peers:

- “China’s output per person remains less than a third of America’s; India’s is smaller still”

- “In 1990 America accounted for about two-fifths of the overall GDP of the G7 group of advanced countries; today it is up to about half”

- “On a per-person basis, American economic output is now about 40% higher than in western Europe and Canada, and 60% higher than in Japan—roughly twice as large as the gaps between them in 1990.”

- “Average wages in America’s poorest state, Mississippi, are higher than the averages in Britain, Canada and Germany.”

- “A decade ago (. . .) many analysts thought that China would, by now, have overtaken America as the world’s biggest economy at current exchange rates. Instead its GDP has been slipping of late, from about 75% of America’s in 2021 to 65% now.”

On productivity:

- “This year the average American worker will generate about $171,000 in economic output, compared with (. . .) $120,000 in the euro area, $118,000 in Britain and $96,000 in Japan.”

- “when assessed on a per-hour basis the gap remains sizeable: 73% productivity growth for American workers since 1990 versus 39% in the euro area, 55% in Britain and 55% in Japan”

On energy dependence:

- “America produces some 13m barrels per day of crude oil and 3bn cubic metres per day of natural gas, making it the world’s biggest producer of both.”

- “Long a major importer of oil, America’s need for foreign crude started to decline in 2008—just when its oil-shale fields really took off. By 2019 it was, for the first time in more than half a century, exporting more energy than it imported.”

America remains the largest and most dynamic economy in the world, and that is why CCM focuses almost 100% of our investments in the United States. The U.S. stock market is by far the largest in the world, with a 61% share of global market capitalization per The Economist. It is also the home such leaders as the “Magnificent Seven” technology companies, whose performance dominates its global competitors (as The Economist points out “Apple, Microsoft and Nvidia together make up an astonishing 12% of the MSCI All Country World Index of stocks”). Meanwhile, the European giants known as “GRANOLA” consists of a much tamer list of GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, and Sanofi.

Our economy faces a host of challenges, and we have made a point to highlight the prevalent risks in our quarterly Commentaries (most recently citing “the upcoming election, a heated geopolitical situation, a dearth of plans to address the growing U.S. budget deficit, and the possibility of an inflation rebound or an unexpected economic downturn”). However, successful investing often requires a positive mindset and the ability of avoiding the trap many investors fall victim to – drawing a false equivalency between the opportunities offered by a strong economy versus low-probability fear-based scenarios.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

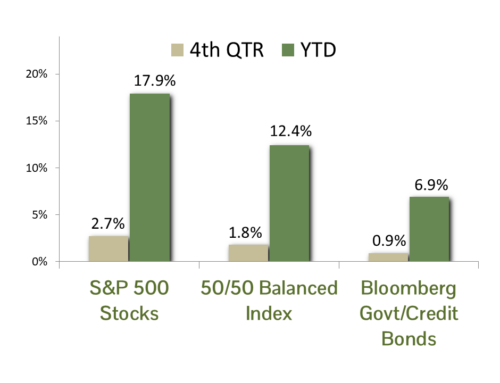

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P 500 Growth Index ® is a stock index administered by Standard & Poor’s-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for growth companies included in the S&P 500. The index identifies growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum.

The S&P 500 Value Index ® is a stock index administered by Standard & Poor’s-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for value companies included in the S&P 500. The index identifies growth stocks using three factors: the ratios of book value, earnings, and sales to price.

The UBS Magnificent 7 Index tracks a group of 7 of the largest mega cap tech stocks listed in the US. The stocks mirror their respective S&P 500 weight and are reweighted pro-rata. Created in Oct 2023. Rebalanced and reconstituted semi-annually.

The Barclay’s Government/Credit Index is the non-securitized component of the U.S. Aggregate Index. The index includes US Treasuries, government-related issues and corporate bonds.

The 50/50 Balanced Index is an index comprised of 50% S&P 500 stocks and 50% Barclay’s Government/Credit Index bonds.

The NASDAQ Composite Index is a readily available, capitalization-weighted index of over 2,500 domestic and international companies listed on the NASDAQ Stock Market.

The MSCI All Country World Index is a market capitalization-weighted index that measures market performance in both developed and emerging markets.

All blended benchmarks are static blends.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Atlanta Fed GDPNow model is a real-time econometric model which forecasts GDP growth in the current quarter.

The Dividend Discount Model is a quantitative model used to predict the price of stocks based on the theory its price worth the sum of all future dividends discounted back to their present value.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The term duration measures how long it takes in years for an investor to be re-paid a bond’s price by the bond’s total cash flows. Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.

The term equity risk premium refers to the excess return over bonds that investors demand to compensate for the greater risk for stocks.