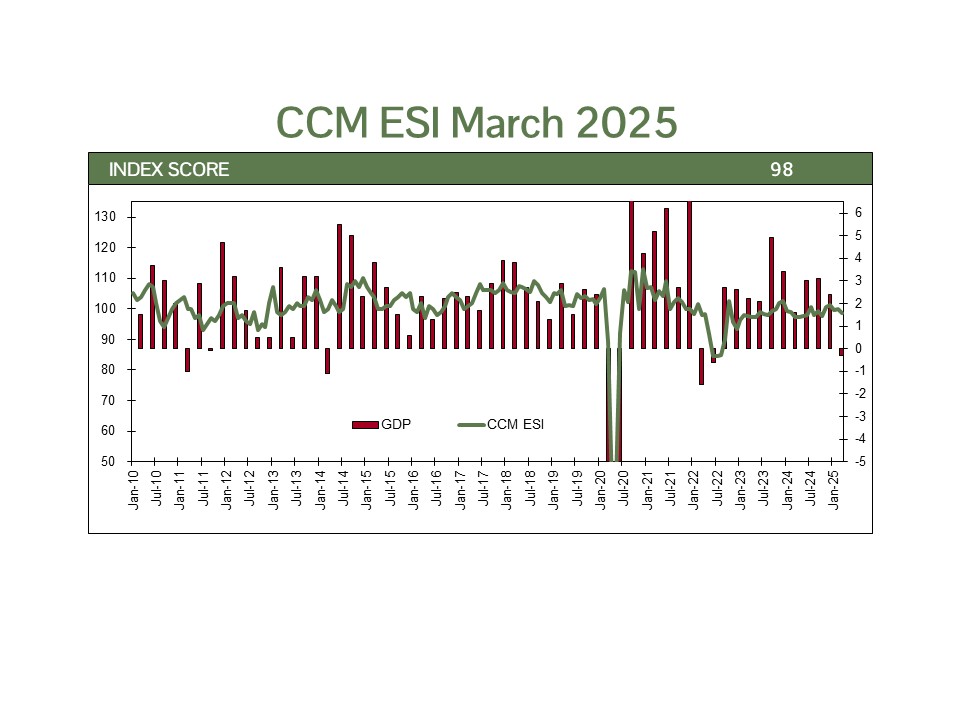

SUMMARY: While headwinds persist in the form of policy uncertainty and residual pricing pressures, strong consumer fundamentals and labor market stability continue to support the expansion. We expect growth to remain positive and inflation to trend lower, providing a more balanced backdrop for policymakers and investors in the quarters ahead.

The state of the economy at the start of 2025 is a mixed picture driven primarily by uncertainty around US trade policy. According to the Bureau of Economic Analysis (BEA), real GDP contracted by 0.3% in the first quarter, marking the first decline in economic output since 2022. This modest pullback was primarily attributed to a temporary surge in imports, as businesses and consumers accelerated purchases ahead of the implementation of new tariffs. A reduction in federal government spending also weighed on overall growth. The contraction reflects transitory distortions rather than a broad-based weakening in underlying economic fundamentals. Recession risks have increased materially, but this is not our current call.

Beneath the surface, the economy continues to show signs of stability. Consumer spending surged by 4.9% on an annualized basis in the first quarter, as reported by the BEA’s Personal Consumption Expenditures report. According to the US Bureau of Labor Statistics (BLS), nonfarm payrolls increased by 177,000 in April, while the unemployment rate remained at 4.2%. Employment gains and stable wage growth continue to support discretionary spending and big-ticket purchases. It seems likely that some of the spending is being pulled forward by tariff fears.

Business activity remained uneven across sectors in early 2025, with recent reports from the Institute for Supply Management (ISM) highlighting a continued divergence between manufacturing and services. The ISM Manufacturing PMI fell to 48.7% in April, indicating a second consecutive month of contraction as production and new orders weakened. Manufacturers cited tariff-related cost pressures and persistent supply chain challenges as key headwinds. In contrast, the ISM Services PMI rose to 51.6%, reflecting modest expansion. New orders in the services sector improved, and while employment remained slightly negative, sentiment was generally more upbeat. Both sectors reported elevated input costs, with the prices paid indices rising sharply, signaling that inflationary pressures are still filtering through supply chains. The data suggest that while goods-producing industries face growing strain, service-oriented businesses continue to show resilience amid a shifting economic landscape.

Inflation trends have shown encouraging signs of moderation. According to the BLS, the Consumer Price Index rose at a 2.4% annualized rate in the first quarter, down meaningfully from levels observed over the past two years and closer to the Federal Reserve’s 2% target. Softer energy prices and easing goods inflation contributed to the decline. Tariff-related costs remain a potential inflation risk.

Most forecasters anticipate a continuation of positive, albeit slower, economic growth. Consensus estimates from Bloomberg forecast GDP growth of 1.4% in 2025 and 1.5% in 2026. The Federal Reserve held rates steady in their May meeting and is widely expected to maintain its current policy stance through most of 2025, with a potential rate cut later in the year contingent on further inflation moderation.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data report represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate, but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

Labor Market Statistics are derived from nonfarm payroll statistics released monthly by the Bureau of Labor.

Technical Terms:

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

ISM Services and ISM Manufacturing are statistics published by the Institute of Supply Management.

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Bureau of Labor Statistics (BLS) hourly earnings tracks total hourly remuneration (in cash or in kind) paid to employees in return for work done (or paid leave).