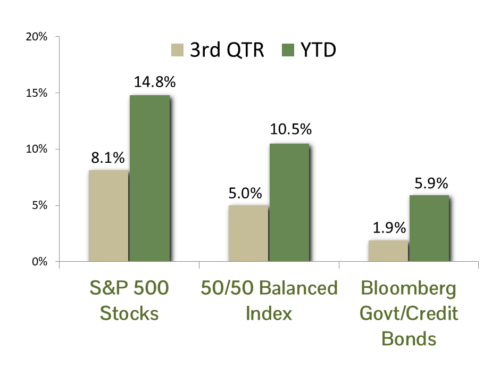

As the stock market has continued its upward trend with the S&P 500 Index returning 19.0% year-to-date (8/27/2024 close), we wanted to share a few comments on the importance of managing risk through consistent asset allocation and portfolio re-balancing (e.g., “taking profits”) — particularly in bull markets.

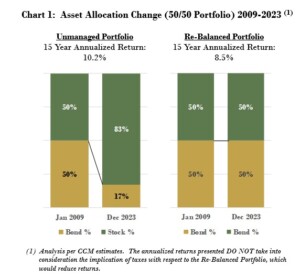

Consider the following historical illustration of two portfolios dating back 15 years to the beginning of the stock market recovery following the Great Financial Crisis in 2009 – each initially invested 50% in Stocks (S&P 500 Index) and 50% in Bonds (BBG US Government/Credit Index).

On the left-hand side of the chart, we allow one portfolio to remain unmanaged throughout the period. While the portfolio generated a very strong 10.2% annualized rate of return through 2023, the resulting underlying asset allocation (of an initially balanced strategy) would have reached a staggering 83% in Stocks and 17% in Bonds! Conversely, when re-balanced annually to a 50/50 allocation (right-hand side of chart), the portfolio still generated an 8.5% annualized rate of return (excluding any tax implications) – AND entered 2024 with only 60% of the corresponding risk and exposure to the equity markets.

We offer 2 additional points of consideration with respect to this 15-year illustration period: First, the Federal Reserve held the federal funds rate very low at 0-0.25% for approximately 9 of these 15 years (following the Financial Crisis and COVID-19 Pandemic). In addition, this analysis references only the broader stock and bond asset allocations — it does not delve into the underlying concentrations in individual holdings. We believe the recent concentration of index performance attributable to “The Magnificent 7” only increases the importance of actively managing asset allocation and security selection within portfolios.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Barclay’s Government/Credit Index is the non-securitized component of the U.S. Aggregate Index. The index includes US Treasuries, government-related issues and corporate bonds.

All blended benchmarks are static blends.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.