This article was originally published May 23, 2024. It has been updated through June 30, 2024.

In conversations with clients we are often asked about the “recession” or “bear market in equities”; neither question is correct. Moving beyond our anecdotal evidence of misconceptions among investors, on May 22, 2024, The Guardian published results of a Harris poll they sanctioned that takes the issue head on. Here are a few misconceptions they uncovered, to which we will briefly respond to as we have with our clients – with the basic facts.

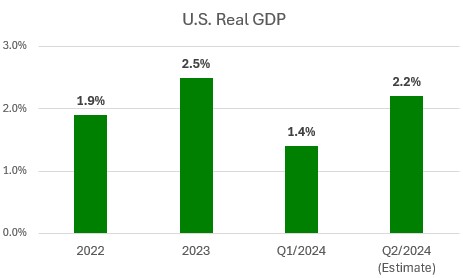

- 55% of Americans believe the economy is shrinking, and 56% think the US is experiencing a recession. The U.S economy grew 2.5% in 2023, which follows 1.9% growth in 2022. For the first quarter of 2024 growth slowed to 1.4%, but the Fed’s GDPNow Model is currently estimating second quarter growth of 2.2% per their June 28 update. There is no economic shrinkage in any of these metrics, and even if there was it is the job of the National Bureau of Economic Research (NBER) to make the official recession call (which they have not). The last official recession was declared by NBER in 2020 during COVID.

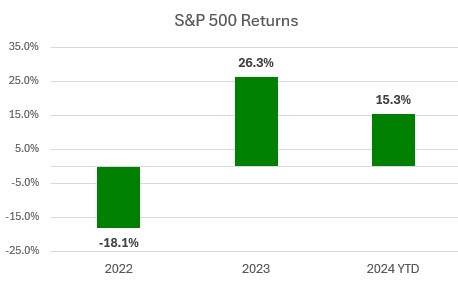

- 49% believe the S&P 500 stock market index is down for the year. The S&P 500 is up 15.3% for the year-to-date through June 30, 2024. This follows a gain of 26.3% in 2023. The last annual loss for the S&P 500 was the 18.1% decline in 2022.

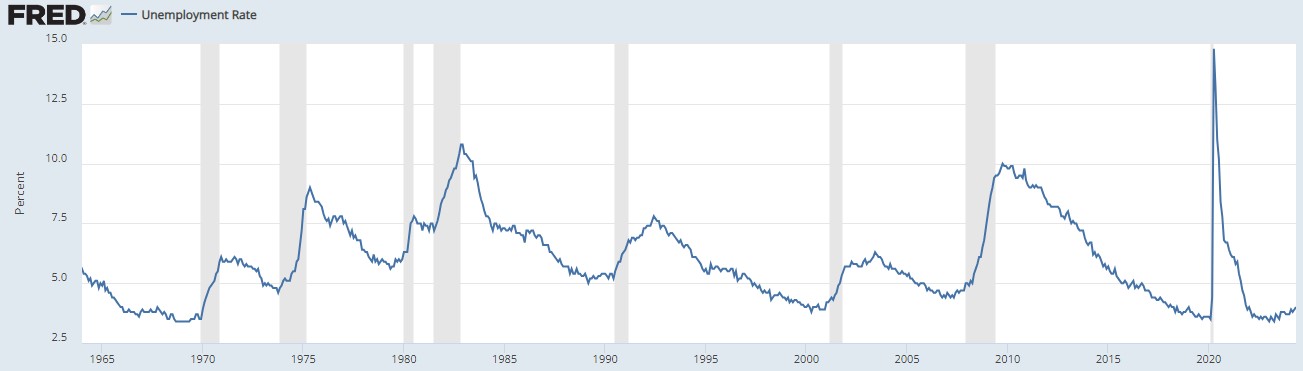

- 49% believe that unemployment is at a 50-year high. Unemployment is at 4.0% through the May report. This is actually near a 50-year low.

- 72% believe that inflation is increasing. Inflation peaked at 9.1% during COVID. It has since declined to 3.3% in May.

Chart Source: New York Times using Bureau of Labor Statistics data

It is obvious (and a bit concerning) that 50% or more Americans do not read the news or at least do not follow the economics and markets pages. The only thing we can concede from these misconceptions is that inflation, though falling, still remains too high. All in all, though, the economic strength we highlighted in the face of near-record low unemployment bodes well for stocks – as it has over the past year and a half. Assuming we continue to make progress on the inflation front the next shoe to drop should be interest rates, a reduction of which which should be conducive for the stock market and certainly so for bonds. Cautious optimism is warranted.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Atlanta Fed GDPNow model is a real-time econometric model which forecasts GDP growth in the current quarter.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

Citigroup Economic Surprise Index represents the sum of the difference between official economic results and forecasts. With a sum over 0, its economic performance generally beats market expectations. With a sum below 0, its economic conditions are generally worse than expected.