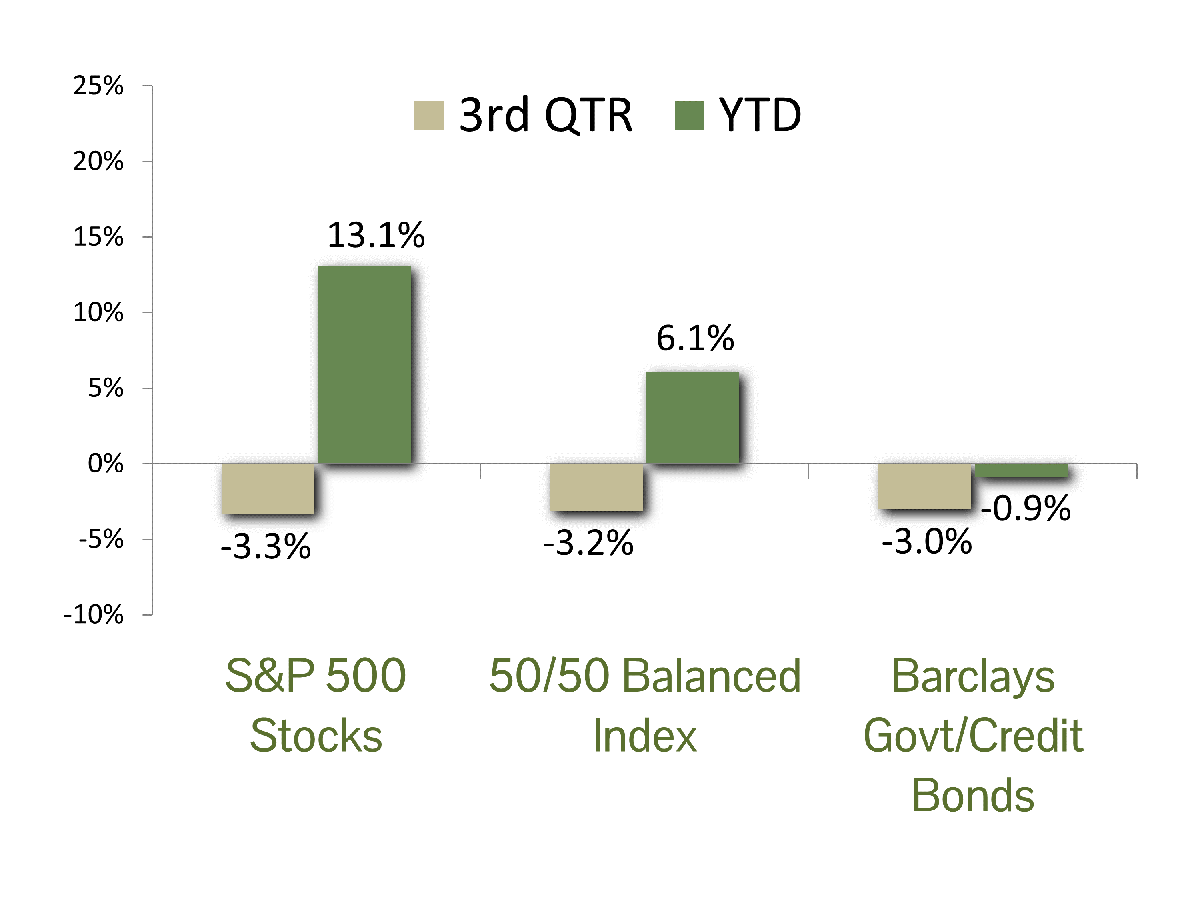

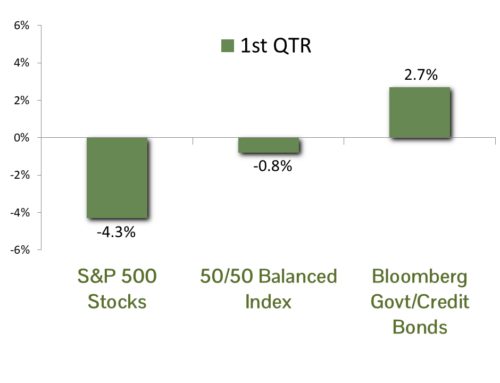

MARKET SUMMARY: Rising interest rates were the story for the markets during the third quarter so we will lead the discussion with bonds. Facing a strong U.S. economy, stubborn inflation and a charged political climate, investors drove yields on the 10-year Treasury from 3.8% at the beginning of the quarter to over 4.5% at quarter’s end – a level not seen since 2007. On the economic front, the Fed’s GDPNow model indicates red hot third-quarter economic growth, and inflation is still running well above the Fed’s target. Meanwhile, dithering in Washington while the budget deficit explodes led to a downgrade for U.S. debt by Fitch on August 1. In the end, the benchmark Barclay’s Government/Credit Bond index declined 3.0% in the third quarter, resulting in a loss for the year of 0.9%. Should it hold through year’s end, it would be an unprecedented third year in a row of bond market declines.

Although the economy and corporate profits were in good health, S&P 500 stocks declined 3.3% in the third quarter. The pronounced uptick in interest rates was the primary driver. Interest rates have a direct relationship with stock prices, as prices are a function of discounting future cash flows, and the higher the interest rate used in the discount function the lower are today’s prices. This is particularly important for technology shares, as many do not pay dividends and their stock prices therefore reflect earnings that may occur well into the future. In spite of the third quarter gloom, it has still been a very good year for stocks, with the benchmark S&P 500 index gaining 13.1% through September 30.

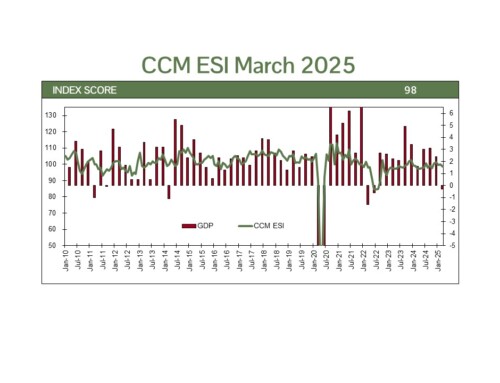

ECONOMIC FORECAST: Forecasts for US economic growth were decidedly negative at the start of the year with almost every prominent economist calling for a recession. That call began to shift in the third quarter as it became clear that government stimulus, strong consumer balance sheets, and employment growth would fuel continued growth. As of this writing, the Atlanta GDPNow forecast is for 4.9% for the third quarter, a far cry from a recession. We remain constructive on growth over the medium term, yet recent events increase the chance of a slowdown over the coming months.

September seems to bring out the most pessimistic parts of the market’s nature, and this year has been no exception. The current worries include:

- UAW strike

- Government shutdown

- Resumption of student loan payments

- Surging oil prices

- A looming commercial real estate crisis

While these concerns are serious, most of them are likely to be resolved in quick order. Additionally, there are offsetting positive trends that support growth. These include onshoring of U.S. manufacturing, productivity enhancements from artificial intelligence (AI), and record fiscal stimulus. These all provide long-term support, which gives us confidence over the coming years. The canary in the coal mine will be how employment holds up over the next few months.

FIXED INCOME STRATEGY: We have maintained a defensive duration position throughout 2023, which has been additive to performance. While we are not necessarily calling a “top” in interest rates, we have become more constructive on fixed income and have been adding duration in portfolios (i.e. extending the average maturity). Despite the risk of “higher for longer” rates, we believe we are much closer to the end of the hiking cycle than the beginning. Additionally, the level of interest rates in fixed income now provides a meaningful carry advantage over equity dividends, which greatly improves the risk/reward tradeoff of adding to fixed income holdings at current levels.

Given that we maintain a modest overweight to equities, we believe the best way to express our fixed income positioning is through a barbell approach to rates and credit. When adding duration, we prefer to utilize U.S. Treasuries & Agencies, thereby instituting a purely interest rate-focused view. On the other hand, we prefer to express our view on credit (corporate bonds) through shorter duration positions, where the spread pickup is still meaningful, but the risk profile is more tempered. While we are not bearish on corporate credit, relative value is not particularly compelling, and given our equity overweight we believe it is prudent to be more defensive against potential spread widening.

EQUITY STRATEGY: The recent stock selloff has disproportionately impacted growth-oriented stocks and the highest dividend-yielding sectors, with the run-up in rates being the most likely culprit. We would characterize the recent 7% stock correction from their July 31 high as the “garden variety” type, as the market takes a breather from its strong uptrend. While there is plenty to worry about at the macro level, we actually see signs of an improving business environment. Analysts have increased their earnings projections for the next several quarters as the growth picture firms. The mega-cap companies continue to boost index-level earnings, but this is beginning to change as increasingly more firms upgrade their outlooks. To date, artificial intelligence (AI) technology advancements have benefited those companies providing the underlying hardware and software. We believe AI’s productivity-enhancing benefits will widen over the coming years as companies integrate the technology into operations. We remain optimistic about the market outlook over the longer term.

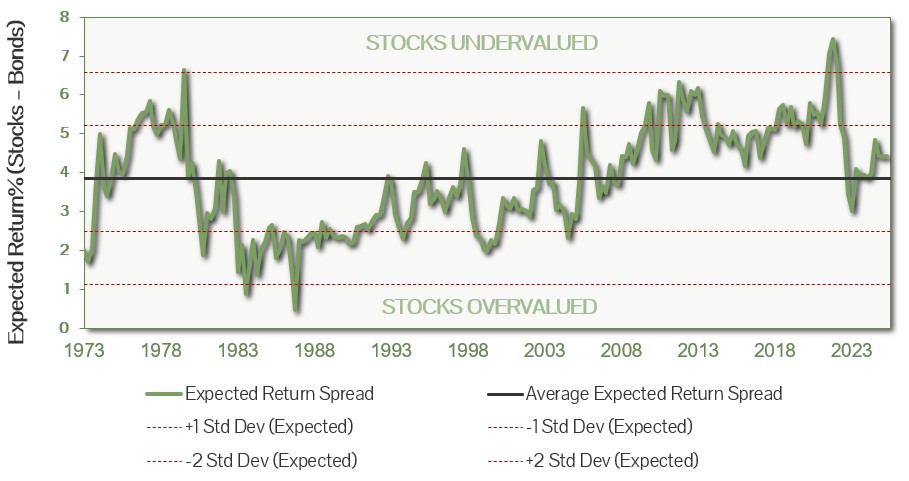

ASSET ALLOCATION: The quantitative aspect of our asset allocation system is a two-factor model based on the long-term expected return for stocks and the current yield for long-dated industrial bonds. Both data points are sourced from Bloomberg, the leading provider of market data. The difference between the two is known as the equity risk premium – the excess return provided by stocks to account for their increased risk. We compare the current premium to the historical data, segmented by standard deviations, to measure the degree of relative attraction of stocks. The output is then confirmed by our qualitative assessment of the economy and markets. In times when there is a gray area the output is sometimes adjusted to mesh with our top-down view.

In the third quarter the expected return for stocks increased by a quarter point, to 10.5%. This was largely due to lower valuations after the selloff and increasing forward profit expectations from company analysts. Meanwhile, long-term industrial bond yields increased by over one-half percent, to 6.1%. The equity risk premium was therefore 4.4%, a slight contraction during the quarter (chart below). The premium remains above the long-term historical average but is less than one standard deviation above the norm – a good example of a gray area. Due to our continued faith in the domestic economy, expectations for further declines in inflation and analysts’ calls for double-digit profit growth in 2024, we are maintaining a modest overweight in stock exposure in balanced accounts. Our confidence in the decision is heightened by the probability that interest rates, the key hindrance for stocks during the quarter, are peaking and will soon decline along with inflation.