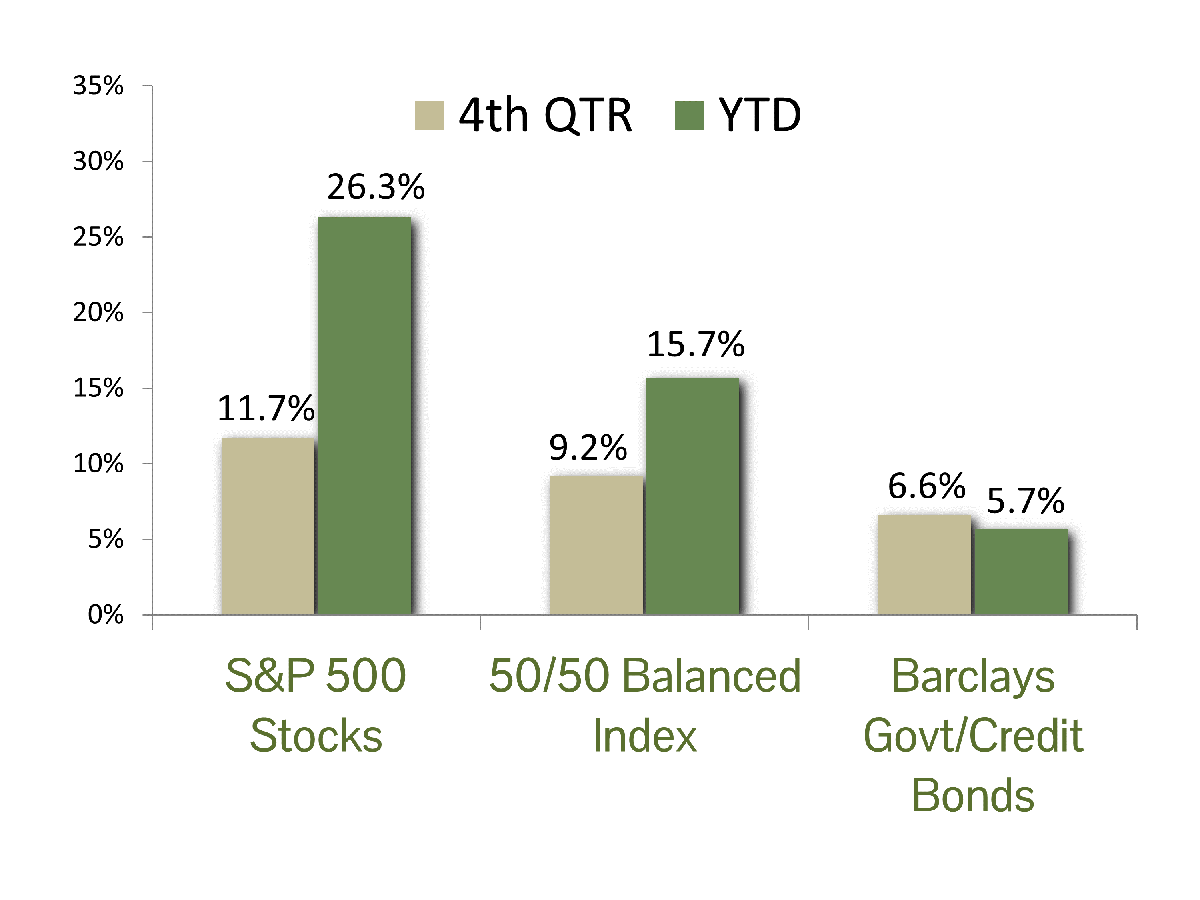

As was the case in the third quarter, interest rates were the determining factor for stock market performance in the fourth quarter of 2023. This time though, it was the complete undoing of the third-quarter interest rate spike, and stocks staged a powerful rebound. The benchmark S&P 500 index gained 11.7% in the fourth quarter, padding the 2023 gain to an impressive 26.3%. The Index is 0.6% from its all-time high set on January 3, 2022, but stocks still closed the year at a record on a total return basis (appreciation plus dividends).

Mega-cap technology shares were far and away the primary drivers of S&P 500 performance in 2023. As measured by the FANG+ index, the shares were up 96.4% for the year, and according to Bloomberg the seven-largest tech stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta) were responsible for 64% of the S&P 500’s return. The top performer in the group was Nvidia, with a stunning gain of 239%. According to TrendMacro calculations, the so-called “Magnificent Seven” were responsible for 78% of the S&P 500’s 2023 earnings growth, though, so perhaps their near doubling in 2023 was not as overblown as it may seem. Our strategy of targeting a broad “basket” of growth shares was crucial to our success with stock selection last year, and our outlook remains positive on growth shares as we enter 2024.

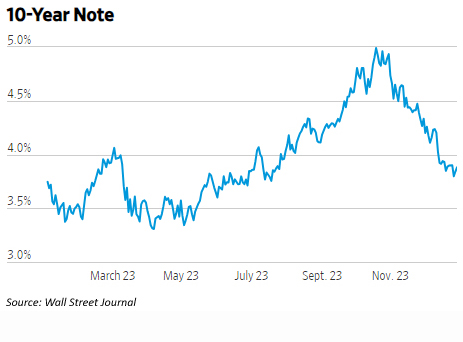

Inflation is the bane for bond investors, and thankfully it appears that its backbone may have finally been broken by an end to COVID-era supply chain disruption and Federal Reserve’s interest rate hikes (though many Fed bashers question the true effectiveness). Through November, core CPI (inflation excluding volatile food and energy prices) was running at a 1.9% annual rate based on trailing six-month data. This is below the Fed’s 2% target, and signals that the next move for interest rates is most likely down. As a result, interest rates declined precipitously during the fourth quarter, unwinding the entirety of their third-quarter advance. The ten-year Treasury yield declined from 4.98% on October 19 to 3.88% at years end (see chart). Bonds, as measured by the benchmark Barclays Government/Credit Index gained 6.6% in the quarter. This resulted in a healthy 5.7% total return for the year and eliminated the dubious distinction of three consecutive years of bond declines. On a cumulative basis, however, the Index is down over 10% over the past three years.

Inflation is the bane for bond investors, and thankfully it appears that its backbone may have finally been broken by an end to COVID-era supply chain disruption and Federal Reserve’s interest rate hikes (though many Fed bashers question the true effectiveness). Through November, core CPI (inflation excluding volatile food and energy prices) was running at a 1.9% annual rate based on trailing six-month data. This is below the Fed’s 2% target, and signals that the next move for interest rates is most likely down. As a result, interest rates declined precipitously during the fourth quarter, unwinding the entirety of their third-quarter advance. The ten-year Treasury yield declined from 4.98% on October 19 to 3.88% at years end (see chart). Bonds, as measured by the benchmark Barclays Government/Credit Index gained 6.6% in the quarter. This resulted in a healthy 5.7% total return for the year and eliminated the dubious distinction of three consecutive years of bond declines. On a cumulative basis, however, the Index is down over 10% over the past three years.

ECONOMIC FORECAST: Growth in 2023 defied the gloomy expectations of professional economists and corporate leaders alike. 2023 GDP is expected to exceed 2.5% on an annual basis based on projections for the final quarter’s number. We believe 2024 will be another year of positive economic growth supported by several persistent tailwinds.

- The labor market remains healthy with firms are looking to fill close to 9M jobs.

- Onshoring of the U.S. supply chain, including high-tech manufacturing, is generating investment in construction and capital.

- Artificial intelligence integration will elevate IT investment in the near to medium term, and substantially enhancing U.S. firms’ productivity over the longer term.

- The shift toward green power generation will contribute positively to economic growth over the next decade.

It is difficult to foresee a recession in 2024 given the healthy consumer and corporate balance sheets and a vibrant job market. One headwind that gives us pause in our rosy call is interest rates. The Federal Reserve is expected to make multiple cuts this year, but a policy mistake is always a concern. Our call is for inflation to fall precipitously, which should force the Fed’s hand to reduce rates.

FIXED INCOME STRATEGY: There was no shortage of fixed income volatility in 2023. More recently, Q3 was defined by a sustained climb in interest rates, whereas Q4 saw a precipitous fall. We believe that peak interest rates are likely now in the rear-view mirror, and the Fed’s next move will be an interest rate cut. Furthermore, the developments in inflation metrics domestically coincide with similar trends abroad. In turn, we believe this indicates most other developed country central banks will begin shifting to easier policy in conjunction with the Fed.

CCM investors benefited from our fixed income positioning in 2023. In the first half of the year, we were notably short duration, which helped us avoid a lot of the associated downside in prices. We began extending duration at the beginning of Q3, mostly through positioning in Treasuries and Agencies. We endured some volatility, but ultimately finished Q4 by participating in what can only be described as a massive rally in fixed income.

The pivotal question going forward is the timing and magnitude of potential interest rate cuts. Coming into 2024, the market has priced in five 25 basis point cuts for the year (via Fed Funds futures), beginning with the Fed’s meeting in March. However, while inflation pressures have been easing recently, prices remain higher than the pre-Covid era, while the labor market and associated gains in real wages remain resilient. Accordingly, we believe there is a risk that the cuts start later in the year and/or ultimately result in less than 125 basis points of cumulative easing. We expect to maintain our increased duration positioning, but subsequent additions will be more tactical as we believe a lot of the “easy” money has already been made. Regardless, on a multi-year horizon, CCM is very constructive on the total return prospects across all investment grade fixed income.

EQUITY STRATEGY: We anticipate a turbulent start to the year as the market digests the strong equity run in the final quarter of 2023. Uncertainty surrounding the Federal Reserve’s future moves, a potential government shutdown, and geopolitical unrest are intensifying investor nervousness. While geopolitical factors remain unpredictable, our call is for interest rates to decline and for the government to resolve any budgetary impasse. Lower interest rates should boost home sales and construction and ease concerns over refinancing in the commercial real estate market. We are fundamentally constructive on equities this year given all the economic tailwinds discussed in our economic forecast.

Artificial intelligence (AI) has been the dominant investment theme since the release of ChatGPT in late 2022. Technology luminaries have hailed it as a historic breakthrough that will change everything from how new medicines are developed to more mundane tasks like booking travel. The first beneficiaries have been hardware manufacturers like NVIDIA and software providers like Microsoft through their partnership with Open AI. While the gains have been spectacular, the productivity they will bring to the world will make the initial gains look paltry by comparison. AI technology is likely to be a significant catalyst for corporate profitability over the remainder of the decade.

ASSET ALLOCATION: Stocks have outperformed bonds in twelve of the fifteen years since the Financial Crisis of 2008, and overweighting stocks in balanced portfolios has been rewarded throughout the period. There have been moments that required true resolve though; in October 2022, Bloomberg Economics reported that there was a 100% chance of recession in 2023. We were among an extremely select few who questioned that monumentally inaccurate “certainty” and remained committed to an overweight in economically sensitive equities in balanced portfolios. As a result, 2023 was a tremendous year for performance.

As the new year begins, we now move on to a new set of challenges. We admit it is a bit disconcerting that the Wall Street consensus has moved so decidedly into our “soft landing” forecast for the U.S. economy in 2024. However, with inflation easing, the Fed likely reversing its course with interest rate hikes, unemployment historically low and consumer balance sheets so healthy, it does appear to be the highest-odds call. Perhaps more importantly, the end result of the stock selloff in 2022 and subsequent recovery in 2023 is that stock prices remain basically unchanged from their high two years ago while profits have increased roughly 9% and are forecast to rise another 10% in 2024. The combination of static prices and growing earnings has reduced price/earnings multiples for the S&P 500 by nearly 5%, suggesting more attractive valuations for stocks. Stocks are particularly attractive versus bonds after their allure has been diminished by their strong fourth quarter rebound.

Nothing is certain and investing involves risk. The only 100% chance we see in 2024 is extreme political rancor and continued global geopolitical strife. This may breed some volatility, but we remain optimistic and will maintain a portfolio positioning that favors stocks. If your risk tolerance or financial situation has changed and you would like to discuss amending your investment policy, please contact us.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P 500 Growth Index ® is a stock index administered by Standard & Poor’s-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for growth companies included in the S&P 500. The index identifies growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum.

The S&P 500 Value Index ® is a stock index administered by Standard & Poor’s-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for value companies included in the S&P 500. The index identifies growth stocks using three factors: the ratios of book value, earnings, and sales to price.

The Barclay’s Government/Credit Index is the non-securitized component of the U.S. Aggregate Index. The index includes US Treasuries, government-related issues and corporate bonds

The 50/50 Balanced Index is an index comprised of 50% S&P 500 stocks and 50% Barclay’s Government/Credit Index bonds.

The NASDAQ Composite Index is a readily available, capitalization-weighted index of over 2,500 domestic and international companies listed on the NASDAQ Stock Market.

The FANG+ Index is an equally-weighted index comprised of Meta, Apple, Amazon, Netflix, Microsoft, Alphabet, Tesla, NVIDIA, Snowflake and AMD. The index is rebalanced quarterly.

The UBS AI Winners basket tracks the performance of 40 US-listed stocks at the forefront of the Generative AI industry. Stock selection is based on input from UBS research analysts, specialty sales, and transcripts/reports. The basket has been optimized for liquidity with initial weights capped at 7% and trades $2.5bn in a day at 20% ADV.

All blended benchmarks are static blends.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Atlanta Fed GDPNow model is a real-time econometric model which forecasts GDP growth in the current quarter.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The term duration measures how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows. Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.

The term equity risk premium refers to the excess return over bonds that investors demand to compensate for the greater risk for stocks.