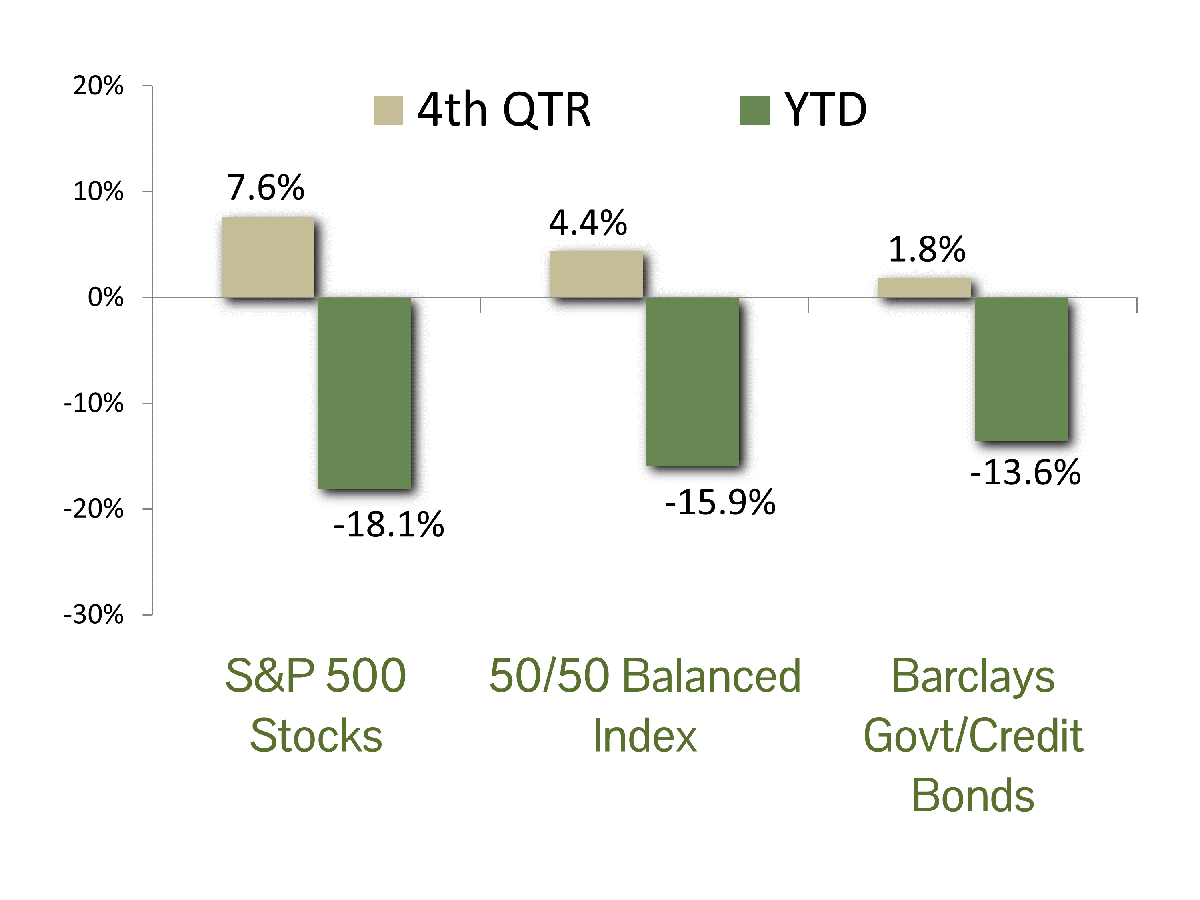

MARKET SUMMARY: Stocks halted their losing streak in the fourth quarter of 2022, as encouraging signs of easing inflation and the hope for a corresponding end to Federal Reserve interest rate hikes gave investors reason for hope. As measured by the benchmark S&P 500 index, stocks gained 7.6% in the fourth quarter. It was only enough to ease the pain, however, as the index posted a steep decline of 18.1% for the year – the worst for stock investors since 2008. Adding to the angst was the extreme degree of volatility for stocks in 2022; according to Goldman Sachs it was the sixth most volatile year since 1929.

As a result of nagging inflation and the Federal Reserve’s response of seven interest rate hikes totaling 4.25%, 2022 was one of the most difficult years for bond investors in history. The ten-year U.S. Treasury note began the year with a yield of 1.6% and climbed steadily to a peak of 4.2% in October. At that point, the benchmark Barclay’s Government/Corporate Bond index had lost over 16% for the year. From there, evidence began to mount of moderating inflation and interest rates declined, ending the year at a 3.9% yield on the ten-year Treasury bond. In the end, the bond index managed a gain of 1.8% in the fourth quarter, narrowing the 2022 for bonds loss to 13.6%. It was easily the worst year for bonds in the last fifty – outpacing the previous record by a multiple of four.

ECONOMIC FORECAST: Inflation was the dominant narrative in the popular and economic press for 2022. The Federal Reserve’s fight to tame inflation resulted in relentless hawkish rhetoric coupled with the fastest policy rate increase since the 1980’s. We argue that the Fed is on the precipice of making a grave policy mistake that would bring unnecessary economic pain, as the latest 50 basis point rate increase came on the heels of the lowest core inflation print seen since February 2021. In fact, inflation actually fell during the month if the owner’s equivalent rent adjustment is removed. Fixed income markets indicate that the Fed’s work is done; now we hold our breath to see if they heed the market’s wisdom to pause.

Outside of home construction and select manufacturing industries, we are constructive on the economic outlook for 2023. The latest consumer confidence survey shows that consumers feel secure about their job prospects and plan to continue spending in the coming months. The survey reveals lingering worries about future economic prospects, yet this measure has improved since the surge in gas prices over the summer. It is difficult to have a recession with such a tight labor market and healthy consumer balance sheets. If a recession does happen next year, it will be the most anticipated one of all time, and blame will fall squarely on Federal Reserve policy.

FIXED INCOME STRATEGY: While there was no way to completely shelter from the storm of the 2020 bond market, the very good news is that we have positioned our fixed income portfolios in a decidedly defensive stance since the Fed dropped the Funds rate essentially to zero two years ago. Losses in typical client portfolios were roughly half that of the 13.6% loss for the benchmark index. With rates at current levels, we have begun cautiously extending average maturities of bond portfolios to lock in these more attractive yields. However, consistent with our philosophy of managing risk first, we will remain relatively defensive. Average maturities will still be well short of the index figure. We continue to maintain an emphasis on high-quality corporate bonds as compared to government bonds in order to add incremental yield.

EQUITY STRATEGY: Equity performance in 2022 is challenging to classify thematically, as multiple cross currents coalesced on markets. The air has come out of the market’s most expensive and speculative areas. Cathie Wood’s ARK Innovation ETF, the epitome of speculative excess, finished the year down nearly 70%. Numerous cryptocurrency implosions roiled investors, with Bitcoin down 64%. The FANG+ Index, which tracks the U.S.’s largest and most expensive companies, fell 40% – more than double that of the S&P 500.

CCM’s strategy of focusing on high-quality, reasonably valued names performed well relative to the S&P 500. While we are never happy with a loss, given the grim investment environment we are pleased with the results. Many of our sector and industry bets added incrementally to our portfolio returns. Here are key strategic plays that led to the outperformance for the year.

- Energy was one of only two sectors in the index with a positive return for the year. We remained overweight in the sector throughout the year, contributing positively to the overall return.

- Healthcare will likely be a long-term overweight, given their level of profitability and the aging demographics of the US. Our equity model selections returned 11.2% for the year versus a loss of 2.0% for the sector.

- FANG companies collectively lost 40% of their value for the year. We managed to avoid over half the loss on the year by limiting our exposure. While total avoidance of these innovative companies would be imprudent given their long-term growth prospects, we are risk managers first and will continue to weight these companies consistent with our mandate for thorough portfolio diversification.

As tough as 2022 was for investors, there is reason to be optimistic about the coming year, as many of the headwinds of the past year are now shifting in favor of risk assets.

- The key cause for optimism is that inflation pressures are likely to continue to wane, allowing central banks to ease their policy rates. Interest rates should decline in this environment, supporting equity valuations.

- The labor market remains healthy and consumer balance sheets remain in good shape. Real wages have lagged, but the expectation of falling inflation will boost buying power in the coming year.

- China’s easing lockdown restrictions will reduce concerns about supply chain issues supporting investors’ risk appetites.

Investors, as always, will have to climb the proverbial wall of worry, which includes the potential for declining corporate earnings, economic recession, the possibility of increased state conflict, and a Fed policy mistake to name a few. On balance, though, 2023 looks promising for equity investors, and we look forward to positive performance.

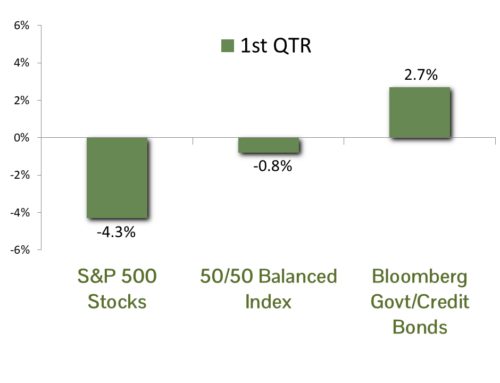

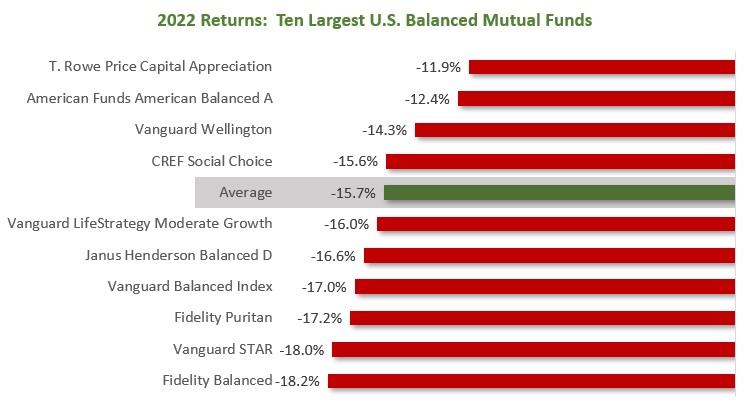

ASSET ALLOCATION: With double-digit losses for both the stock and bond markets, 2022 was a very difficult year for performance in balanced portfolios. At their lows in October, performance for a typical domestic 60% stock/40% bond portfolio (“60/40” in our jargon) was the worst since 1937. For CCM, although our absolute returns were dreary, our performance relative to the loss of 16.3% for the 60/40 balanced index and 15.7% decline for the ten largest U.S. balanced mutual funds was exceptional. The relative strength we delivered was the result of a timely asset allocation change in March, successful stock picking and handily outperforming on the fixed income side of the portfolio.

While the financial press was littered with slews of “death of the 60/40” articles last year, the prevailing outlook for balanced portfolios is now quite rosy. Stock market valuations have improved significantly (double-digit price declines in the wake of continued earnings growth) and bond yields have become quite enticing (4% to 5% yields for intermediate-term corporate bonds). In this environment our asset allocation system is rather indifferent in terms of stock/bond preference, but our eye on the fundamental situation suggests maintaining a modest overweighting in stock exposure in balanced portfolios.

The management of portfolio risk is our primary concern, and we continue to be cautious. For the fixed income component, that includes thorough credit research and a defensive view on bond maturities. On the stock side, we believe downside protection is offered in large-cap “go-to” names with strong profits and reasonable valuations. First-of-the-year market forecasts are a fool’s errand, but the bulk of the market excesses were shaken out in 2022 and the conditions are now ripe for a solid rebound for both the stock and bond markets in 2023.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ Composite Index is a readily available, capitalization-weighted index of over 2,500 domestic and international companies listed on the NASDAQ Stock Market.

The Barclay’s Government/Credit Index is the non-securitized component of the U.S. Aggregate Index. The index includes US Treasuries, government-related issues and corporate bonds

The ICE BofAML 0-3 Month US Treasury Bill Index is a subset of ICE BofAML US Treasury Bill Index including all securities with a remaining term to final maturity less than 3 months.

All blended benchmarks are static blends.

Technical Terms (definitions sourced from Investopedia)

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The 10-Year Treasury Note is a debt obligation issued by the United States government that matures in 10 years.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The Producer Price Index (PPI) measures the average change over time in the prices domestic producers receive for their output. It is a measure of inflation at the wholesale level that is compiled from thousands of indexes measuring producer prices by industry and product category. The index is published monthly by the U.S. Bureau of Labor Statistics (BLS)