Frequently we are asked by investors who are opening a new account or who are making a deposit into an existing account, “is now a good time to be buying stocks?” It’s a fair question, as most investors want to see their investments appreciate rather than depreciate. We know that stocks go up and down, and we further know that buying high and selling low is not a winning strategy.

Listen to any market analysis and pundits typically will share their opinions as to the short-term direction of stocks. We at CCM are a bit more humble in our short-term forecasting ability as experience has taught us that such forecasts are exceptionally difficult. There will always be reasonable odds that stocks will decline in the short term.

Fortunately, there is a simple way to improve the odds of a profitable investment. We know that stock prices fluctuate based on a number of factors, but two very important ones are investor sentiment and the underlying earnings that stocks produce. Investor sentiment can be measured indirectly by examining what investors are willing to pay for a unit of earnings of a stock. That’s best measured by the well known price/earnings or PE ratio. Investors are willing to pay more for stocks – think higher PE ratios – when they are optimistic than when they are pessimistic. Periods of optimism inevitably lead to periods of pessimism. But the important point is that these emotions cycle.

While the PE ratio is a measure of sentiment, we cannot forget that the “E” in the ratio is not fixed. If investor sentiment is held constant, as earnings increase, the price of a stock should increase also. Take a stock with a PE ratio of 20. If earnings (E) equals $2/share, the stock will sell for $40. If the PE ratio remains constant and earnings increase to $3/share, the stock will increase in price to $60.

Obviously in a competitive economy there are winners and losers – some companies prosper while others do not. However, if that competitive economy is expanding, on the whole, earnings of companies comprising that economy will increase. A broadly diversified stock portfolio likewise should reflect an increase in earnings.

Experience tells us that the US economy has grown steadily over time. Recessions (and even depressions) occur, but inevitably the economy recovers. Since January 1, 1947, US GDP has grown from $2.1 Trillion to $22.9 Trillion as of June 30, 2024 (source: Federal Reserve Bank of St. Louis). Similarly, the US stock market reflects that growing from 229 in January 1947 to 5,466 in June 2024, as measured by the S&P 500 (Source: Macrotrends.net).

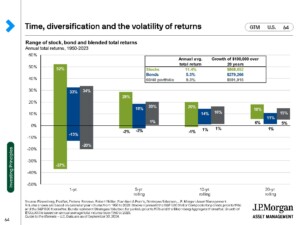

Consider the following chart courtesy of J P Morgan which looks at returns for stocks, bonds and a theoretical portfolio consisting of 60% stocks and 40% bonds for rolling one-, five-, ten- and twenty-year periods over the time frame 1950 – 2023. As you can see, the worst return for a stock portfolio over one year during that 74 year time frame was -37%. However, stretch the holding period out to five years and the worst annualized return is dramatically reduced to -2%. The best annualized return for that period was a sparkling 29%. The worst return over twenty years was a positive 6% while the best return was 18%. Add bonds into the portfolio and you can see that there were no five-, ten-, or twenty-year periods where the portfolio suffered a loss. Of course, these are historical returns, which as we know, are not predictors of future returns. Still the evidence supports the notion that a growing economy supports positive returns to stocks over time.

So back to the question of “is it a good time?” The answer is yes – if you have a sufficiently long time frame to recover from a market downturn soon after an initial investment. Investors with a short time frame such as a year or two should be conservative with their investments. A short-term, high-quality bond portfolio might be appropriate in this instance. Investors with longer time horizons, such as a retirement in ten years, are positioned to assume more risk in pursuit of higher returns. While not without risk, longer term investors can reasonably expect positive returns from a portfolio of stocks or stocks and bonds.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.