LABOR MARKET

The U.S. labor market is losing steam as the post-pandemic hiring momentum slows. In August, payrolls increased by 142,000, falling short of the 165,000 forecasted. Additionally, revisions for the prior two months subtracted 113,000 jobs, further underscoring the trend of decelerating job growth. The Bureau of Labor Statistics also released its annual benchmark revision in August, drawing significant attention. This adjustment showed that 818,000 fewer jobs were created in the year ending March 2024 than previously reported. While this is a more extensive revision than usual, the economy still added 2.1 million jobs over that period—a historically solid figure. These developments signal a moderating labor market but do not suggest an imminent recession.

CONSUMER

By most objective metrics, the U.S. consumer is in good financial health. Although inflation has weighed on sentiment, as reflected in consumer surveys, spending continues to rise. Over the past 12 months, consumer spending increased by 5.2%, outpacing the 4.6% rise in income over the same period. While some commentators highlight the risks a declining savings rate poses, we contend the increased spending points to consumer confidence in prospects. Inflation has undoubtedly affected households unevenly, but consumers, in aggregate, are earning more in real terms than they did pre-pandemic. From January 2020 to July 2024, the Consumer Price Index (CPI) rose 4.3%, while personal incomes (PCE) grew 5.8%. We expect consumer financial conditions to strengthen as inflation continues to ease.

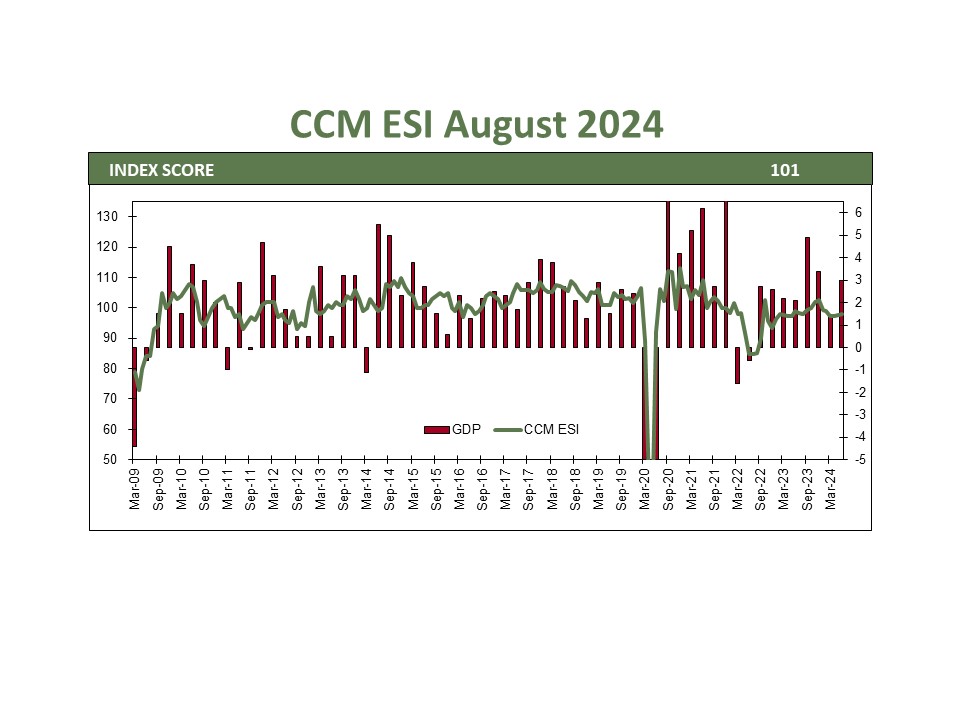

BUSINESS OUTLOOK

The two ISM reports offer contrasting views on U.S. business activity. The ISM Manufacturing PMI has contracted in 21 of the past 22 months, largely due to the pandemic-driven shift in consumer spending from goods to services. On the other hand, the ISM Services PMI has expanded in 19 of the past 22 months, buoyed by a surge in travel and leisure spending. Since services comprise roughly two-thirds of U.S. economic activity, overall business conditions are best described as moderate. The headwinds of high interest rates, inflation, and political uncertainty have weighed on business sentiment and expansion. Still, as these pressures fade, the business outlook should improve in the coming quarters.

CONCLUSION

The U.S. economy continues to grow despite challenges stemming from the pandemic and its aftermath. Factors like manufacturing reshoring, increased infrastructure spending, and declining inflation are expected to act as tailwinds in the quarters ahead, supporting further economic expansion. The Federal Reserve is widely expected to lower interest rates in September, although the extent of the cut remains uncertain. Declining rates benefit interest rate-sensitive sectors like real estate, offering another avenue for growth. While risks remain, we maintain a constructive outlook on U.S. economic growth.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

The S&P 500 Index ® is a readily available, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Technical Terms:

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

The Personal Consumption Expenditures (PCE) includes a measure of consumer spending on goods and services among households in the U.S. The PCE is used as a mechanism to gauge how much earned income of households is being spent on current consumption for various goods and services.

ISM Services and ISM Manufacturing are statistics published by the Institute of Supply Management.