Over the years investors were trained that bonds provided the income in a portfolio while stocks provided capital appreciation plus some current income in the form of dividends. That philosophy made good sense when bond yields were in the 5% to 10% range. It also meant that in the “traditional” 60/40 portfolio (stocks/bonds) one could count on a very reliable interest income of roughly 2% to 4% of the portfolio value, plus whatever you could pick from dividends. But what about now when the yield to maturity on the Barclays Global Capital Government Credit Index is under 2.0%? Do bonds make any sense at all?

In 1952, Professor Harry Markowitz developed Modern Portfolio Theory (MPT) which introduced the concept of combining stocks, bonds and other assets in varying allocations to optimize the tradeoff of risk and return potential in portfolios. A corollary of MPT is the concept of Total Return, which simply states that an investor’s return is the sum of any income produced by the portfolio in the form of dividends or interest plus any capital gains (or losses) that the portfolio may produce. Total return became increasing popular as corporations began retaining more of their earnings and reinvesting in their business rather than paying out earnings as dividends. Total return advocates proposed that investors could create their own dividends by selling shares as they appreciated due to wise investments by companies.

The effect of dividend payout reductions and declining bond yields was that the poor investor was left with less so called “current income,” that is, interest and dividends, and was forced to rely more heavily on “homemade dividends” created by selling shares or bonds. Homemade dividends are perfectly fine and in some cases more attractive than traditional dividend and interest income due to tax policy. However, because they rely on capital gains to some extent, homemade dividends are inextricably linked to the volatility of a portfolio. If an investor has set a goal of withdrawing say 1% of their portfolio on a quarterly basis (4% per year), those draws will be impacted by fluctuations of the portfolio valuation. This matters a great deal to investors like retirees who have fixed bills and want a steady stream of income.

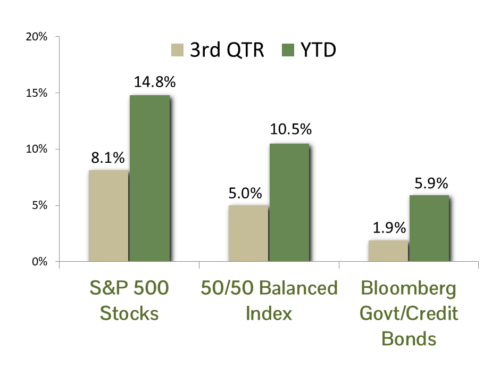

Even if they are not making periodic withdrawals from a portfolio, investors have different risk tolerances. Some will lay awake in bed fretting about a 5% correction in their portfolio value while others are perfectly fine with much larger fluctuations. Enter Professor Markowitz’s insight on combining various asset classes to optimize the trade-off of risk and return. Because the return patterns of stocks and bonds are dissimilar, adding bonds to a portfolio of stocks tends to make the portfolio less volatile. Investors can choose the mix of stocks and bonds that creates the appropriate level of risk and return potential for their needs. Balanced investors, for example, were pleased during the 2000 – 2002 “Tech Wreck” when stocks were down 37.5% for the period but bonds were up 34.7%. The same was true later in 2008 when stocks were off 37% and bonds were up 6%. The retired investor who is taking periodic draws will likely want more bonds in the portfolio because such an allocation equates to more steady withdrawal rates, given a static withdrawal percentage such as 4%.

The beauty of a total return investment approach in today’s low yield/dividend environment is that it offers investors the opportunity to enjoy the fruits of their capital gains. Bonds are in the portfolio not specifically to provide interest income, but rather to serve as a counter balance to the more volatile stock component of the portfolio. Think of bonds as shock absorbers for the portfolio. Low bond yields are frustrating, but we own them for the portfolio risk reduction characteristics rather than current income.