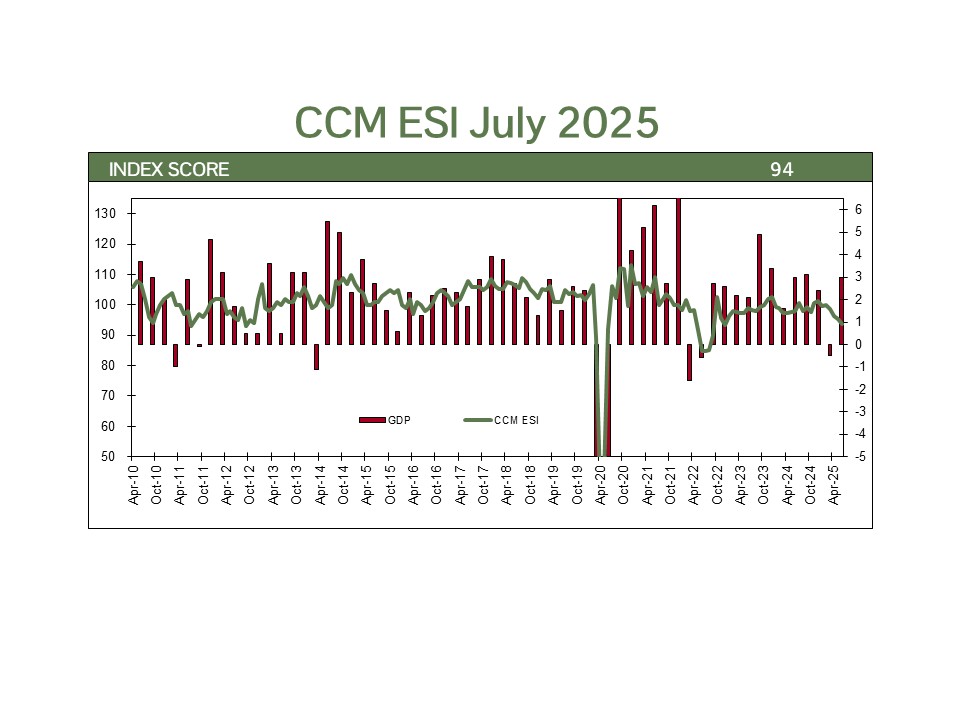

Recent economic data suggest the U.S. economy is losing momentum as the effects of tariffs, higher costs, and a softening labor market ripple through the system. July’s employment and business activity reports point to slower growth, increasing the likelihood that the Federal Reserve will begin cutting interest rates as early as its September meeting.

The July employment report provided the clearest sign of cooling. Nonfarm payrolls rose by just 73,000, well below the 104,000 consensus. Even more concerning, prior months were revised lower by 258,000 jobs, bringing the three-month average to a mere 35,000, the weakest pace since the early pandemic recovery. Job gains were concentrated in health care and education, while most other sectors, including manufacturing, shed workers. The unemployment rate edged up to 4.2%, and labor force participation slipped further to 62.2%.

ISM surveys reinforce this slowing backdrop. U.S. manufacturing activity shrank for the fifth straight month in July, with the index dropping to 48, its weakest reading in nine months. The weakness was driven by fewer new orders and the steepest employment decline since 2020. Ten of 17 industries reported shrinking activity amid tariff-driven cost pressures and capital spending delays. Services activity nearly stalled, with the ISM Services index slipping to 50.1. Respondents cited project delays, margin compression from rising costs, and a second consecutive month of employment contraction, with hiring mostly confined to health care and social assistance.

While the recent weakness could prove temporary as businesses adapt to the new economic landscape, caution is warranted. The labor force is shrinking under tighter immigration policies, and several headline trade and foreign investment agreements remain preliminary, with details still to be finalized. There are, however, meaningful tailwinds that could support growth—including AI data center expansion, power generation projects, onshoring of manufacturing, and increased home construction. Ultimately, businesses need policy clarity to make hiring and capital allocation decisions, and that certainty is in short supply. We remain cautiously optimistic that clarity will emerge before the slowdown deepens further.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data report represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate, but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Labor Market Statistics are derived from nonfarm payroll statistics released monthly by the Bureau of Labor.

The ISM Manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at manufacturing firms nationwide The ISM Services index is based on surveys sent to purchasing and supply companies of more than 400 services firms. Both are considered to be key indicators of the state of the U.S. economy.

The Bloomberg Professional service was used as reference for all economic statistics unless otherwise noted.