Welcome to the SCSFA Web Portal

Welcome to the SCSFA Web Portal

Welcome to the South Carolina State Firefighter’s Association (SCSFA) Retirement Plan and Trust for Paid Firefighters and the Length of Service Awards Program (LOSAP) for Volunteer Firefighters web portal provided by CCM Investment Advisors.

We are honored to have been selected to manage the investment pools under these two plans on your behalf and we look forward to working with you.

CCM Overview

CCM Overview

The attached slides are intended to give you a very high level overview of our firm. In addition, the link to our website provides detailed background information on our investment process. Our only business is the active management of investment portfolios. Clients include endowments, foundations, retirement plans such as the SCSFA, insurance companies, trusts and individuals. We celebrate our 30th anniversary this year – a milestone we are proud of. At the same time we are humbled as we recognize that this success is only the result of our clients’ continued trust in our management of their financial affairs. We look forward to earning yours.

Returns

Returns

SCSFA Investment Options

SCSFA Investment Options

Aggressive Portfolio

Aggressive Portfolio

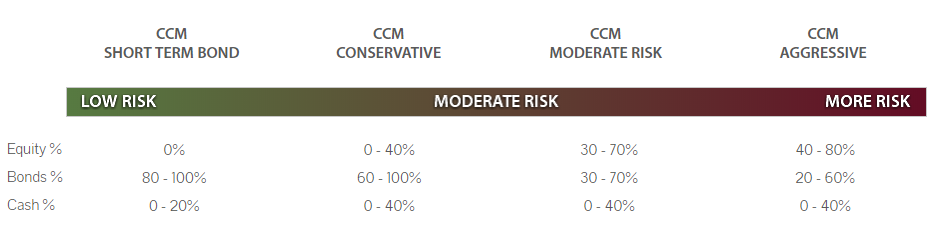

This balanced approach is designed to generate returns significantly in excess of the rate of inflation over the longer term, but will conversely incur substantial short term risk to invested capital. Investment performance should be judged over a three to five year time horizon versus a typical balanced (60% stocks/40% bonds) portfolio.

Moderate Risk Portfolio

Moderate Risk Portfolio

This balanced approach is designed to generate returns significantly in excess of the rate of inflation over the longer term, but will conversely incur substantial short term risk to invested capital. Investment performance should be judged over a three to five year time horizon versus a typical conservative balanced (50% stocks/50% bonds) portfolio.

Conservative Portfolio

Conservative Portfolio

This portfolio is designed to generate stabilized rates of return on an annualized basis with low risk to invested capital. Time horizon is three to five years. Investment performance should be judged over a three to five year time horizon versus very conservative balanced (20% stocks/80% bonds) portfolio.

Short Term Bond Portfolio

Short Term Bond Portfolio

An investment grade fixed income portfolio with limited risk. This portfolio is appropriate for participants anticipating withdrawal of their funds within the next two to three years.

Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Any performance data reported represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.