Investment Philosophy

Investment Philosophy

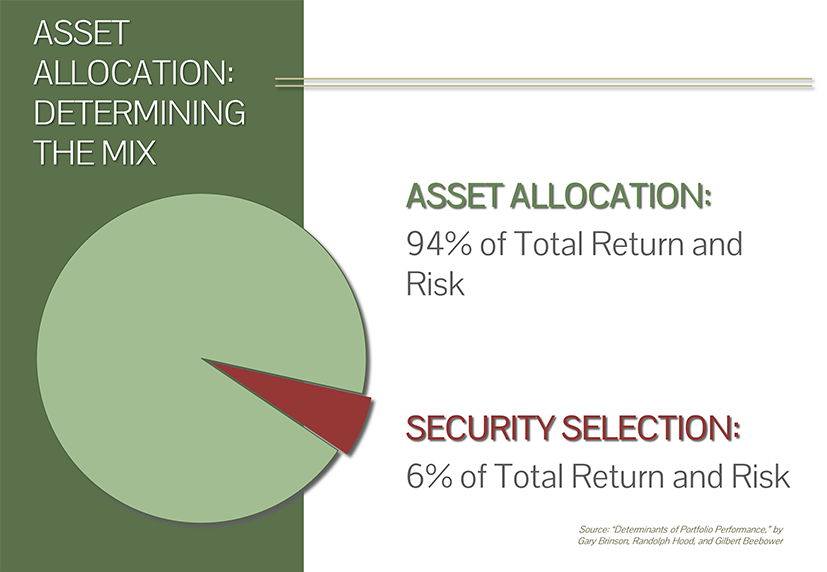

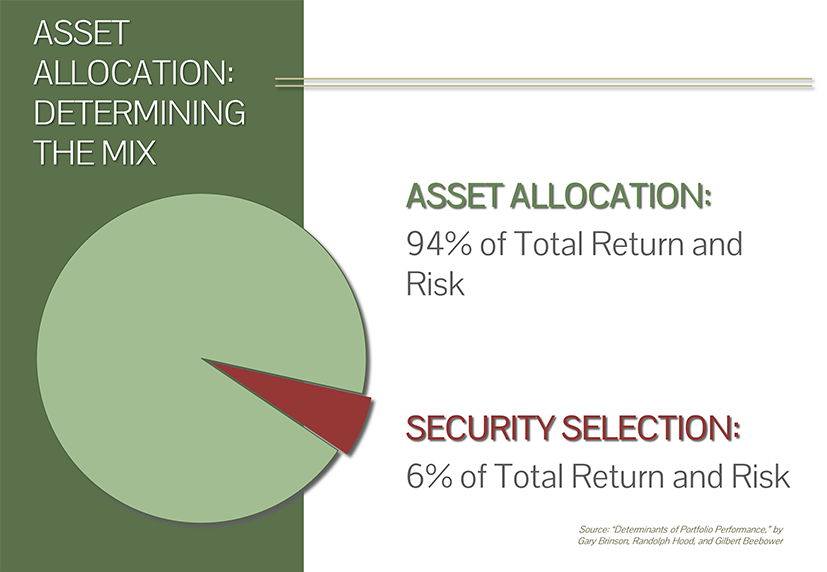

At CCM Investment Advisers, we believe a disciplined total portfolio management system that identifies relative value among asset classes, as well as individual securities, will provide superior long-term investment performance. Our philosophy dictates that we manage risk first. Through the management of risk we ascertain value, which ultimately drives performance. Our investment philosophy is based on the active management of the three basic decisions of portfolio management: asset allocation, security selection and timing. Traditionally, other portfolio managers actively manage only the second two parts of the investment process: selection and timing. However, at CCM, we believe in order to minimize risk and maximize the total return of a portfolio consistent with each client’s investment objectives, it is necessary to actively manage all three aspects of the investment process.

Equity Selection Process

Equity Selection Process

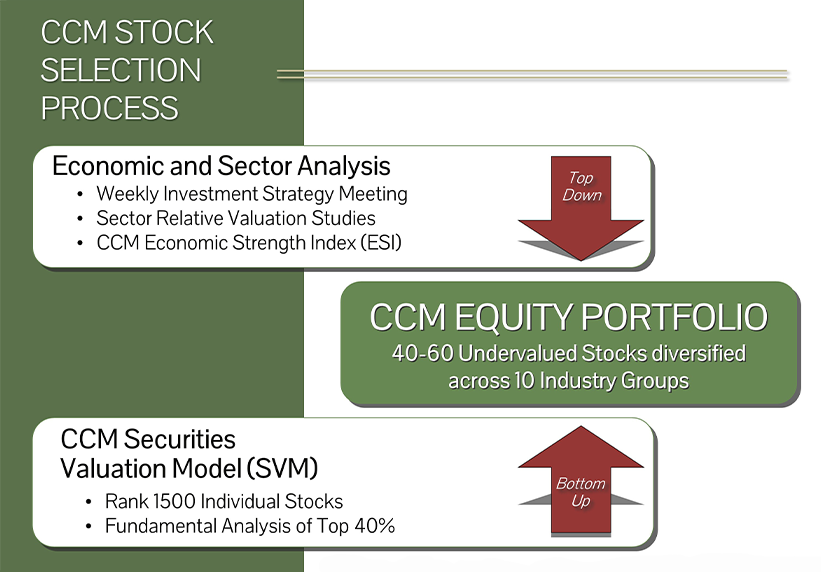

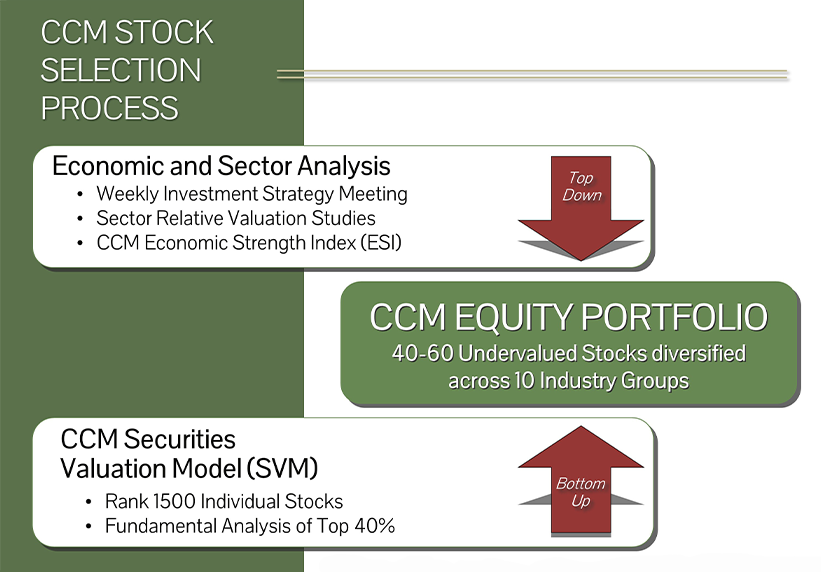

Our stock selection process is an extension of the relative value philosophy present throughout our investment management system. The process is based on the premise that in the short run, equity markets are not “efficient,” and relative value can be identified through fundamental analysis.

We screen relevant financial data on over 1,500 public companies to identify potential investment candidates. These candidates include both growth and value stocks and must meet stringent financial criteria. As investment managers, we are looking for longer term relative value. We are not short term traders or speculators. Our approach searches for opportunities to profit in portfolios over the long term and only assumes risk consistent with expected potential return. Ultimately, our equity selection process results in the structuring of broadly diversified stock portfolios (35 to 65 positions).

Fixed Income Selection Process

Fixed Income Selection Process

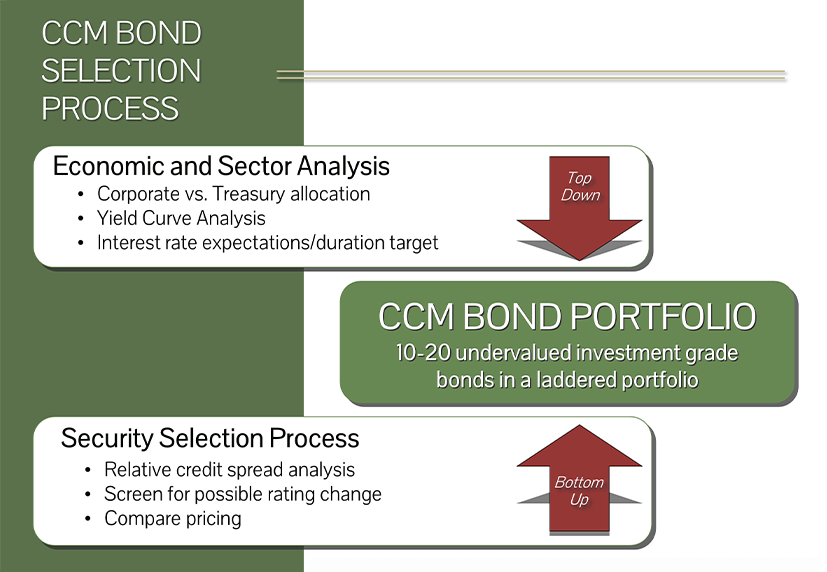

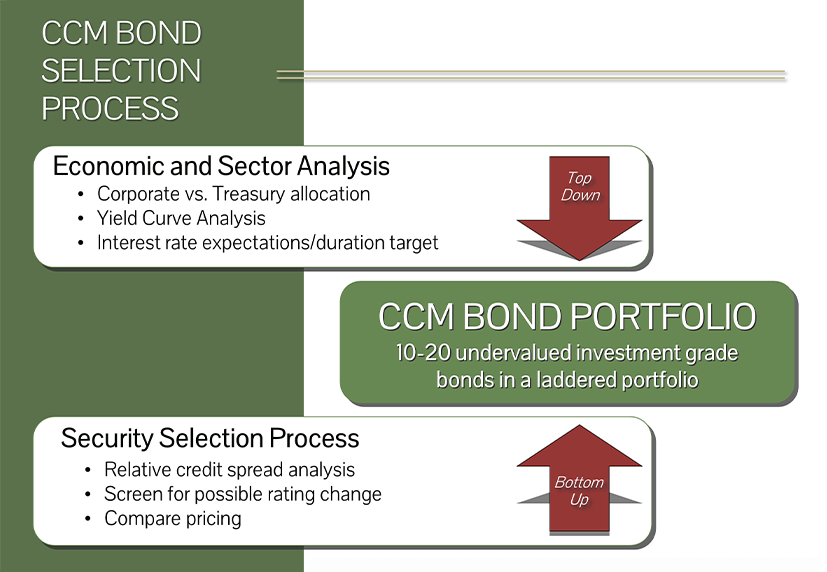

As interest rate anticipators, our fixed income selection process begins with the formulation of our economic forecast. The forecast includes our expectations for changes in interest rates and the yield curve. The target duration and maturity structure is then determined based on these expectations.

Security selection begins with relative value analysis, involving the evaluation of current market sector spreads, quality spreads, and specific security factors. We actively manage our fixed income portfolios to take advantage of inefficiencies within the different sectors of the fixed income markets. Implementation of these strategies when identifying undervalued bonds adds incremental return to the original portfolio duration decision.

Balanced Investment Process

Balanced Investment Process

We believe that a disciplined, dynamic total portfolio management system that identifies relative value among asset classes, as well as individual securities, will provide consistently superior investment performance. Accordingly, our investment management process actively addresses all three basic decisions of portfolio management – asset allocation, security selection and timing.

Our system compares the relative value of stocks, bonds and money market alternatives. The asset allocation system disciplines the portfolio manager to shift funds from overvalued assets to relatively undervalued assets within a timely, logical, and unbiased framework. Our core balanced approach is appropriate for conservative investors desiring a competitive market return with considerable principal protection.

Complete array of investment approaches across the risk spectrum.

Resources

Resources

Market Commentary

Market Commentary

CCM quarterly market comments and periodic research on asset allocation and the fixed income and equity markets.