Inflation: The US growth picture remains constructive in early 2025, yet a few worrying trends are emerging. Inflation has increased since September after contracting the previous 27 months. The Consumer Price Index (CPI) rose by 0.5% in January, primarily from higher shelter, food, and transportation costs. The 12-month headline figure expanded 3.0%, while the core component of the index, which strips out volatile food and energy prices, grew at an even faster rate of 3.3%. Resurging inflation has dampened hopes for a lower Fed Funds rate, with markets now expecting only one cut by year-end. While we hope this month’s number is an anomaly, BLS hourly earnings has been outpacing inflation since April 2024, forcing companies to raise prices to keep up. Immigration enforcement could further increase wage pressures as the supply of cheap labor contracts.

Labor Market: The economy added 143,000 jobs in January, slightly below economists’ expectations of 169,000. Despite this, unemployment increased to 4.0% from 4.1% last month. Revisions for November and December added 100,000 jobs, indicating a more robust job market than previously reported. Jobless claims have also been near post-pandemic lows, pointing to continued labor market strength. Average hourly earnings increased by 0.5% in January, translating to a 4.1% rise over the past year. This wage growth outpaces the 3.0% inflation rate in January, suggesting more real income gains for workers. We expect the job market conditions to tighten throughout the year as the labor pool contracts further.

Business Environment: The latest ISM surveys indicate a healthy US business sector. The ISM manufacturing index reached 50.9 after being in contraction territory since October 2022. The report is a welcome sign that businesses are expanding again after the uncertainty around the 2024 elections abated. The ISM services report showed a modest expansion at 52.8, cooling slightly from last month. Service price increases are beginning to abate, although they remain elevated. Overall, both sectors are experiencing growth, with manufacturing showing signs of recovery and services maintaining expansion, though at a slower rate.

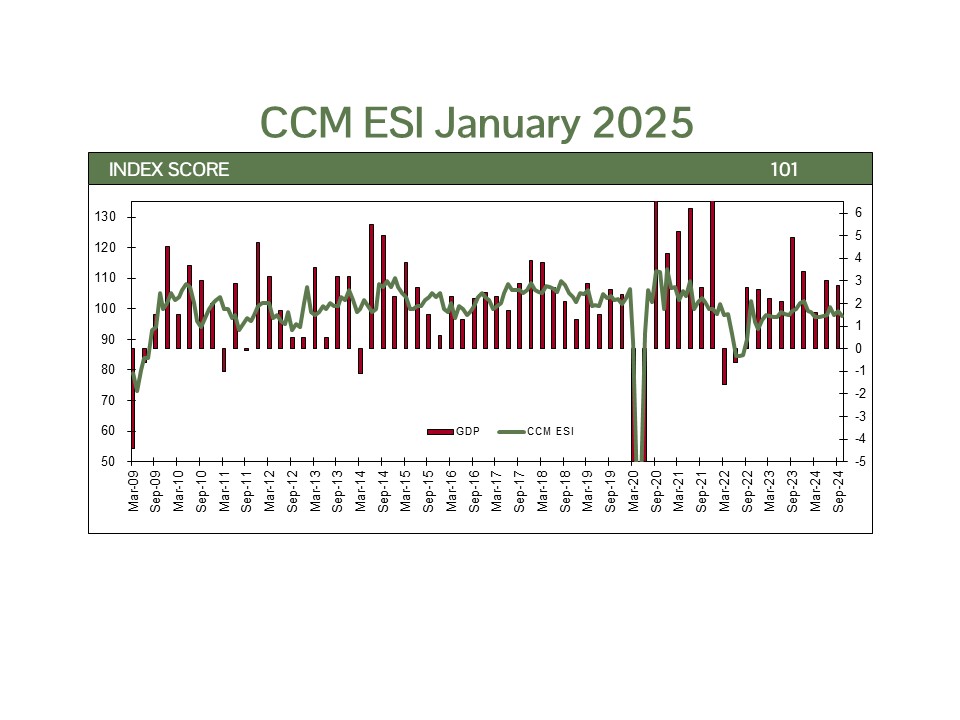

Economic Policy: Bloomberg’s economic growth estimates indicate a more modest GDP growth of 2.1% for 2025, down from 2.8% last year. We could see considerable deviations from that estimate depending on how the administration’s economic policies balance. Tariffs could stimulate domestic manufacturing, lead to more trade, or push affected countries to dig in their heels and institute counter-tariffs on US goods. Immigration reform in an already tight labor force may push wages to the point that it reignites inflation, forcing the Fed to reverse course. While necessary for debt reduction, government spending reforms will likely reduce GDP growth but could reduce interest rates as debt level concerns subside. The open question is how all these policies will affect capital investment and consumer spending behavior. Our sense is that, on balance, policies will prove economically stimulative, but with so many changes occurring simultaneously, caution is warranted.

CCM Investment Advisers, LLC is a Registered Investment Adviser registered with the U.S. Securities and Exchange Commission (CRD# 105743). Any type of investing involves risk of loss and there are no guarantees that the strategies described on this website or any of the associated literature may be successful. The opinions and information contained in this report are for informational purposes only and are not meant to be predictors of future results. Such opinions and information do not constitute an offer or solicitation to provide investment advisory services. Such an offer can only be made in states where CCM Investment Advisers is registered.

Any type of investing involves risk of loss and there are no guarantees that the strategies described may be successful. Any performance data report represents historical data and future returns may differ significantly. Past performance does not guarantee future results. CCM Investment Advisers does not assume liability for any loss which may result from the reliance by any person upon such information or opinions.

Security, index and economic information are obtained from resources which CCM believes to be accurate, but no warrant is made to the accuracy or completeness of the information. Various indices described and discussed herein are unmanaged; investments cannot be made directly into an index. Indices do not incur fees that reduce performance. The performance and volatility of an index or mix of indices will not be the same as a CCM client account.

Labor Market Statistics are derived from nonfarm payroll statistics released monthly by the Bureau of Labor.

Technical Terms:

The Consumer Price Index (CPI) is a measure of the monthly change in prices paid by consumers. The CPI consists of a bundle of commonly purchased goods and services. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

ISM Services and ISM Manufacturing are statistics published by the Institute of Supply Management.

The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

The Bureau of Labor Statistics (BLS) hourly earnings tracks total hourly remuneration (in cash or in kind) paid to employees in return for work done (or paid leave).